Get a free EIN! Seriously, you shouldn’t be paying for an EIN. It’s a free service online through the IRS. The process isn’t all that hard either. What follows is the steps you need for your EIN.

How Do I Get A Free EIN?

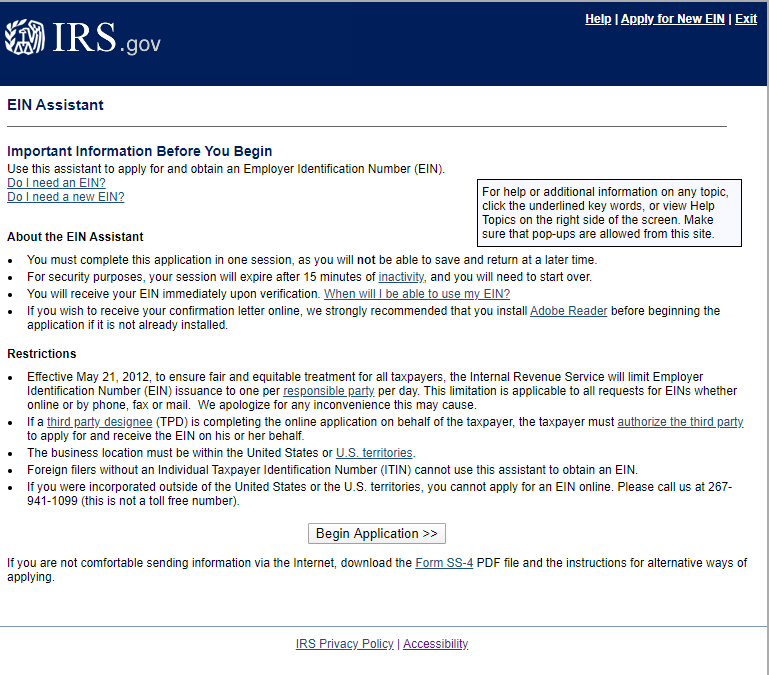

First, you need to go to the IRS website where you obtain the EIN. Here’s the link to make things easy for you. Then, you click the “Apply Online Now” button. Keep in mind you can only apply for an EIN between the hours of 7am to 10pm EST, for some reason.

You should see the above screen. If you see that above, you’re in the right place! If not, either you’re in the wrong place or my blog is outdated.

Begin Application

Next, click “Begin Application>>”.

To make things easier, we’re going to get an EIN for a fake LLC. Our LLC just got its articles back from the Secretary of State. In your case, you should use your specific facts. For LLCs and corporations, you should get your EIN only after you get your approved articles back. Can’t get the tax ID until the entity exists.

So…. select “Limited Liability Company” and move to the next page. The next page will be a description of what your company type is. Read this and make sure it matches your entity.

Members

Next, you need to tell the IRS how many members there are and what state the company is located. For us, there’s 1 member and we’re located in North Carolina. You should enter the number of members you have right now. That portion can change. The location is where the company is, regardless of where the articles were filed. We’ll get to that.

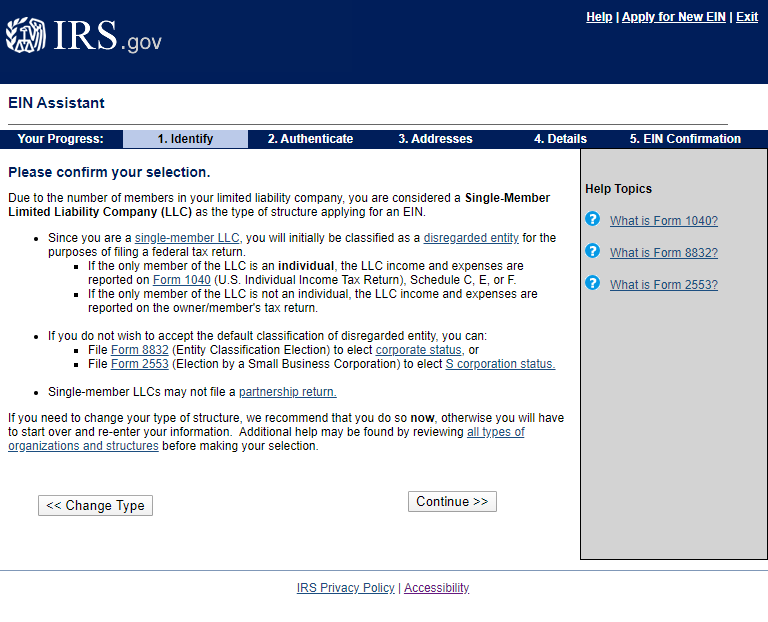

After that section, you should see the following screen.

This has some great information about changing tax classification! Definitely keep this as reference.

The Why

Next, the IRS asks why you want an EIN. 99% of my clients select “Started a New Business.” The other choices are fairly specific and self explanatory. Funny enough, I’ve never selected 3 out of the 5 choices.

Responsible Party

On the next screen, you have possibly the most confusing part of this process. Fortunately, I have super clear guidance for you!

If you’re filing for the EIN for your own business, you’re the responsible party. If you’re filing for someone else, one of the owners is the responsible party. It isn’t clear, but the responsible party is actually just the contact point for the IRS. This person is not accepting responsibility for the taxes if the company doesn’t pay.

You have to submit a social security number or ITIN to the IRS as the responsible party. Unfortunately, if you’re in a situation where you have neither, you’ll have to go through a process of calling the IRS and submitting a paper application. Sadly, that increases the amount of work ten fold.

The Where

Next, the IRS needs to know where your business is located. Even if you don’t have a physical office, you need to give the IRS a location. Generally, businesses without an office put the address of one of the owners. Fortunately, the IRS does not publish this address.

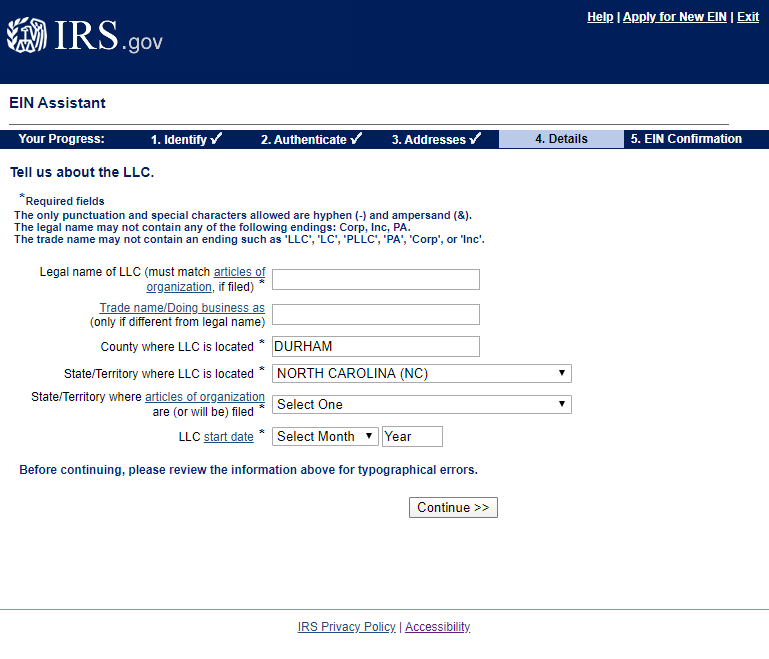

Tell us about the LLC

On the next page, the IRS is asking about the legal aspects of the LLC. The information they’re asking for is relatively simple.

To help you out, here are some tips I’ve learned about this screen. First, the legal name must include “llc” or “inc” but you cannot include comma or periods. Second, do not put a trade name in unless you’ve filed for an assumed name or DBA. Third, the state where the LLC is located must match what you put earlier. Fourth, your LLC start date must match what your articles say.

If you follow all of those tips, this screen is super easy.

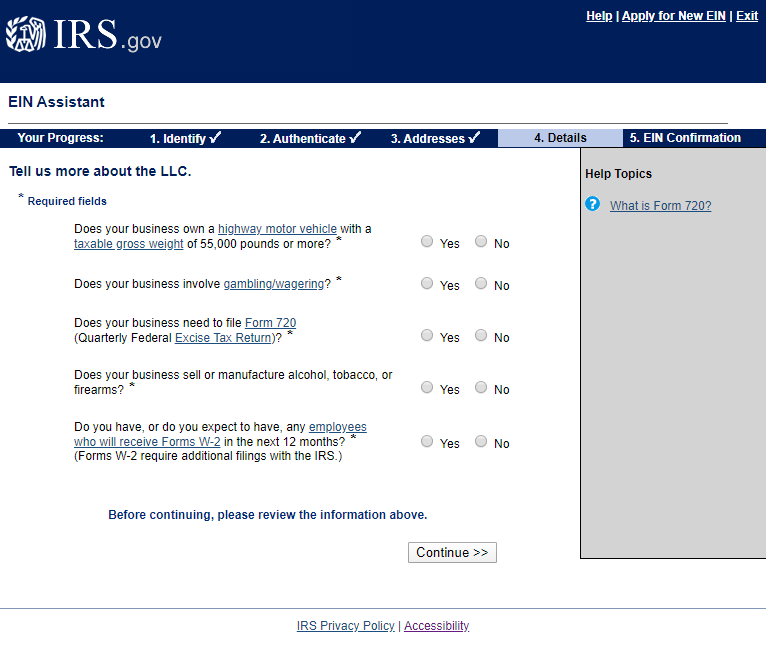

Questions Page

This is my favorite page. It’s a bunch of questions you are likely going to answer “no” for. The only one most people likely answer yes for is whether you will have employees in the first 12 months. For this questions, don’t worry if you don’t know. If you don’t know, I recommend clicking no. If you click yes, the IRS will send you information about setting up with holdings, but you can get that information at anytime.

What does your business or organization do?

Once you’ve moved on, the next page is interesting. It is asking you what industry you’re in. Interestingly enough, service providers have to click other and move onto a second page. Find whatever is closest and then click continue.

Once you’ve chosen an industry, you’re asked if you want the letter by mail or pdf. If you have software that reads a pdf, choose that one. It is the same letter, but you don’t have to wait 4-8 weeks.

Tada! A Free EIN!

Finally, you’ve reached the summary page. Make sure all the information is correct and then click submit.

If everything is entered correctly, you should get a link to click to obtain your EIN letter. Save it and print it immediately. Getting a replacement one involves you calling the IRS. If you know anything about the IRS, you know that calling them is not fun.

There, you’re done! You have a free EIN. It was easy. And, now you understand why you shouldn’t pay $80 to some online company.

Leave a Reply