In order to form an LLC in North Carolina, you file your LLC Articles of Organization with the Secretary of State. Fortunately, we’ve made this process easy!

Before Filing

Before you even fill out your articles of organization, there are some things you need to do. First and foremost, you need to make sure your desired name is available. This isn’t as simple as checking the Secretary of State’s website. You also need to ensure you’re not infringing on any trademarks or other rights.

Additionally, you should make sure LLC is the correct entity type for you. Without knowing your specific situation, it is impossible to know whether you would be better served with an LLC or some other type.

Articles of Organization

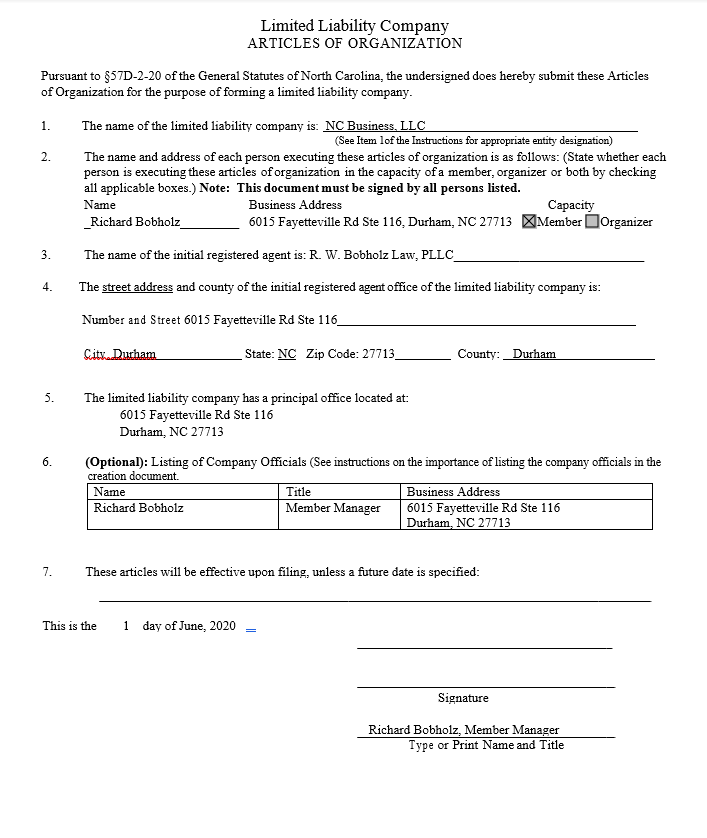

We’ve provided these sample Articles for your benefit. You can download a completely blank pdf version from SOSNC.gov.

In addition to all the resources we provide, the Secretary of State has a lot of useful articles and guides.

You are more than welcome to add more terms to your articles than those listed here. However, the ones in our sample are either required by law or strongly recommended.

Line by Line

- Name. This is self explanatory. All you need to do fill in your desired company name. Be sure to include “LLC” or “Limited Liability Company” in the name. This is a legal requirement.

- For this item, all you need to do is list yourself. Check the box “Member” because you’re an owner. Attorneys will be listed as “Organizer” because they’re not the owners.

- Registered agent is the person or entity that is responsible for receiving important government notices and lawsuits. You are required by law to have an in-state registered agent to receive these notices. The registered agent can be yourself if you would like. However, if you miss these notices, the Secretary of State can dissolve your company.

- Just list the address of the registered agent.

- Principal office location is an optional provision. I highly recommend listing one if have an actual office location. The purpose behind the office location is a secondary point of contact for the Secretary of State if they can’t reach your registered agent. This helps protect you from dissolution.

- Although number 6 says optional, it really shouldn’t be. Your bank and any other entities you work with will want to see who your officers are. If you’re the sole owner, list yourself as “Member Manager”. Otherwise, list any owners who can make management decisions as “Member Manager” and the rest as “Member”.

- I frequently leave number 7 blank because I prefer my articles be filed as soon as possible. However, there are times when it makes a difference. For example, a lot of people want their companies formed January 1 to avoid dealing with an extra year’s annual report requirement.

- Finally, you need to date, sign, and print your name and title at the bottom. If you’re the owner, you sign as Member Manager.

Filing Articles of Organization

After you complete your articles, you need to file them with the Secretary of State. You can do that online, by mail, or in person. You can also choose to file with 24 hour rush delivery for an extra $100. Otherwise, the filing fee is $127.

EIN

After you file your articles of organization and get them approved, you must obtain your EIN. We’ve written on this before, but don’t pay anything for your EIN. It is a 5 minute process that is free and easy to complete.

Operating Agreement

You will also need an operating agreement. This document outlines the ownership and the terms of the company as a whole. Operating agreements are similar to the bylaws and equity agreements that corporations have.

Leave a Reply