We all know broadly what liability means. If you make a mistake, hurt someone, or owe someone, you’re liable to them. However, there are a lot of different types of liability, and each ones comes with their own set of rules.

Taxes

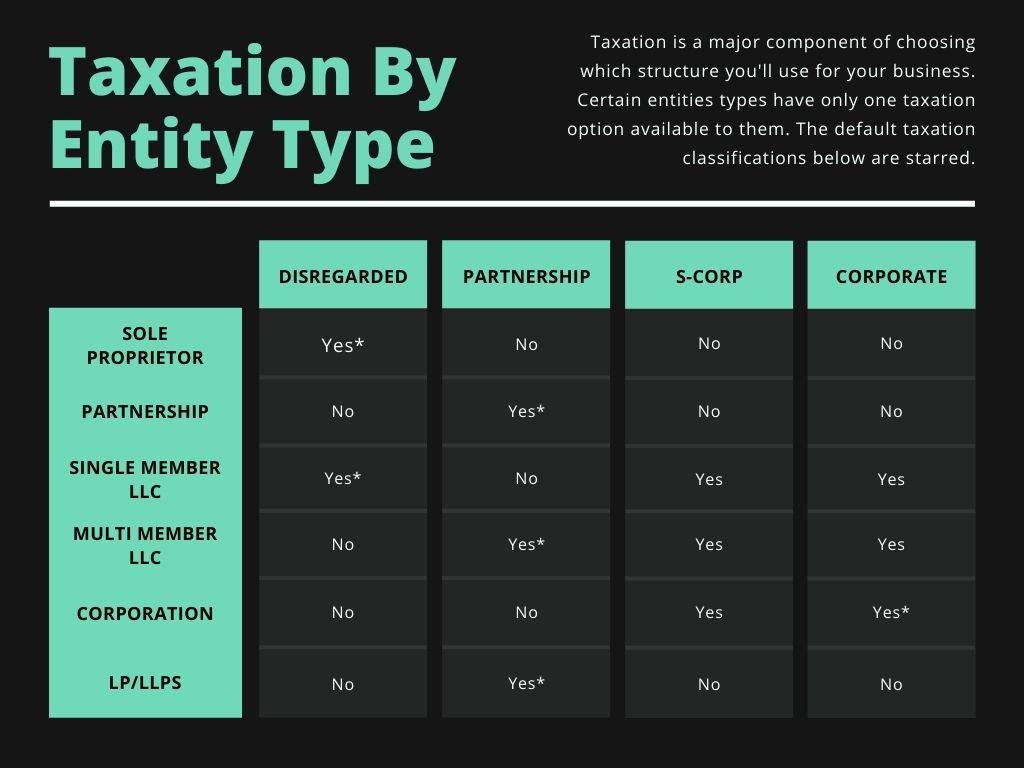

Tax liability is unique, as it should be. The amount you owe in taxes, as a business, depends on the type of entity you are, how much you make, and even often what your business does.

For example, a sole proprietor who fixes cars will be taxed as a disregarded entity, meaning all the income gets reported on that individual’s 1040.

However, a corporation reports income separately and then the individuals report the wages, dividends, or other income on their taxes separately. Here’s a handy chart for determining what tax types apply to what business structures:

Tax liability is typically half of the equation when picking an entity type. However, as said before, the traditional small business would typically be fine with a corporation or LLC absent a compelling reason one way or the other.

Contracts

Contracts are another big area of liability for companies. However, it’s also the most manageable form of liability. The things that fall into this category, however, reach far and wide. For example, the purchase of a candy bar is a contract, but so is your partnership agreement.

Unless there’s a specific rule against it, you can limit your contractual liability almost entirely.

A quick pet peev: If you draft a contract that says you’re not liable, even for breaches under that contract, in any way, that’s probably an invalid contract. You can limit your liability to a point, but making it so you can breach the contract with no repercussions means the contract is illusory.

Professional Liability

You don’t have to be a lawyer to have professional liability. Every service provider has it. For example, if you’re installing a TV in a client’s house, you’re personally liable if you do a terrible job.

The thing about this type of liability is that it falls on both the business and the person actually doing the work. Therefore, if you’re the business owner and the installer, the client could sue both you and the business if it’s a separate legal entity like an LLC. However, if an employee is the installer, the customer can no longer sue you personally unless you don’t have a limited liability entity.

This is one of those areas it is pretty important to have an LLC or corporation to protect your personal assets. However, it’s important to know that certain professions cannot limit their personal liability from these professional actions. Attorneys are one of those professions. In those cases, insurance plays an even more critical role than the legal entity.

Negligence

Negligence is basically your accidents that hurt someone or their property. As one of my law professors stated, “someone dumb did something dumb and a dumb result occurred.” We actually spent a lot of time talking about people who got stuck in railroad tracks, so just avoid those I guess.

Negligence arises when you have a duty to another person, you breach that duty, resulting directly and proximately in damages. Mostly, this comes up with a customer gets hurt or you damage their property. For example, if a customer slips and falls in your grocery store because you didn’t put up a wet floor sign, that’s classic negligence.

Can you limit this type? Somewhat. We’ve all heard of waivers, and those work to some extent. However, if you have customers that can come and go in your place of business, you’re not having everyone sign a waiver. Putting up signs like “enter at your own risk” only go so far.

Fortunately, unless you’re the one who made that spill and didn’t clean it up, the liability goes exclusively to your business. Therefore, you can protect your personal assets fairly easily.

Employees

Employees can be great. They can also be your greatest headache. Generally, a business is liable for anything an employee does in the scope of their employment, even if what they did was stupid or wrong. If it’s within the scope, it’s the business’s problem. It’s called Respondeat Superior if you wanted to look it up.

Fortunately, if your business is an LLC or corporation, the liability flows to that entity and not your personal assets. If you have employees, you definitely should have a filed entity. The protection you get from corporations and LLCs is the same.

Mitigating Liability

The beautiful thing about contracts is you can put in a limitation of liability clause. Not only can you list what the maximum damages someone would be entitled to against you, you can also outline who can be held liable. In your case, this is gold. You can limit your defendant’s recourse to the assets held by your LLC and not you personally.

However, if you have an empty LLC, that LLC had no involvement in the transaction, or the LLC was just a façade, the defendant might be able to pierce that LLC and go after your personal assets instead. A normally run company that happens to be an LLC is fairly safe from being pierced though.

Limited Liability

What does limited liability mean? Limited liability means you are not personally liable for the debts and obligations of the company. This only works if your business is an LLC or corporation. However, as you can see above, you and your business can share some debts. Professional liability, negligence, and sometimes taxes are all shared. You can mitigate these some through contracts.

Leave a Reply