When you start a business, you need to consider the business entity type you’re going to operate as. If you don’t choose a type, one will be chosen for you. The default options area almost always the wrong choice.

This article is going to be a cursory overview of the different entity types. It is, by no means, the only resource you should use when deciding which one to operate as.

Let’s dive in and discuss what they are.

Sole Proprietor

Let’s say you start making and selling bird houses out of your garage. As soon as you start doing that, you’re in business for yourself. If you didn’t file something with the state, you’re a sole proprietor.

In the case of selling birdhouses, is it a bad thing to be a sole proprietor? Probably not. In this case, how much liability are you really creating? And, how much of that liability can you avoid by having a limited liability entity as your shield? Again, probably not a lot.

Partnership

You create a partnership in exactly the same way as a sole proprietor, except it occurs when you have multiple owners. Unfortunately, it’s sometimes hard to determine (1) when a venture begins and (2) who is entitled to some ownership stake.

Look at Facebook. Zuckerberg was sued because the plaintiffs believed they were entitled to some ownership from early on. Being an incredibly costly case and almost impossible to prove ownership, they settled for a lot of money. I call this the “accidental partnership.”

One major downside to partnerships is the unlimited personal liability. If one of the partners screws up, every partner could be personally liable for the resulting damages. This can be devastating. However, you can avoid this liability by forming an LLC or corporation instead.

Limited Liability Company

Next, we have the limited liability company. This is a hybrid business entity. Structurally, the LLC is like a partnership. However, it comes with limited liability. That means your house isn’t on the line for business debts. Over the past couple decades, people have chosen the LLC more often than any other type.

The LLC is the structure of choice largely because of its flexibility. However, I would argue that branding and misinformation have also helped it become so popular. For example, everyone on the internet discusses the scary “double taxation” of corporations. However, that’s not really a thing in small businesses.

Corporation

The corporation was invented hundreds of years ago as a way to separate the liability of a company from ownership. In other words, it’s a legal principle that protects owners from the actions of the company. Good or bad, it’s what we’ve got. Before the corporation, you could sue every owner of a business if that business harmed you. However, now you’re only able to sue the business itself. I could discuss my thoughts on this all day, but that’s not why you’re here.

Corporations, unlike the other entity types, are separate legal entities. The lines between ownership and the business are blurred in LLCs and partnerships. However, a corporation has a clear delineation. In a corporation, owners elect a board of directors. That board of directions elects or appoints the management of the company. It’s with this separation that we create the limited liability nature of corporations.

Because of this separation, owners working in the corporation are employees. They have most all the same rights as any other employee in the corporation. Actually, the less percentage of the corporation they own, the more rights they get. For the most part, this won’t impact you, so we don’t need to dive into these.

Nonprofit

A nonprofit is a unique business entity type. In North Carolina, nonprofit corporations are corporations without ownership. Instead, a board of directors manages them, but they serve the public or some subset therein. In most respects, their structure is the same as any other corporation. If they have legal members, the members elect a board of directors who appoints management. If they don’t have members, the board elects other board members.

Also different, nonprofits have a duty to maximize their affect on their mission. Conversely, for-profit corporations have a duty to maximize profits. There are plenty of other differences between for-profits and nonprofits.

Limited Partnerships

Limited partnerships were very popular for a while. If you see businesses that have “LP” or “LLP” or even “LLLP” at the end, those are limited partnerships. Basically, a limited partnership is a partnership where some of the partners have limited liability protection. In all these types of limited partnerships, at least one partner must be a general partner. The general partner is subject to the full liability of the business. Ergo, you can see why these are no longer as popular since the LLC provides liability protection to all its owners.

People still use limited partnerships in very specific circumstances. I’ve seen them used for asset protection, estate planning, and real estate investing circumstances. If you’re setting up a company for a typical small business, this is not the business entity for you.

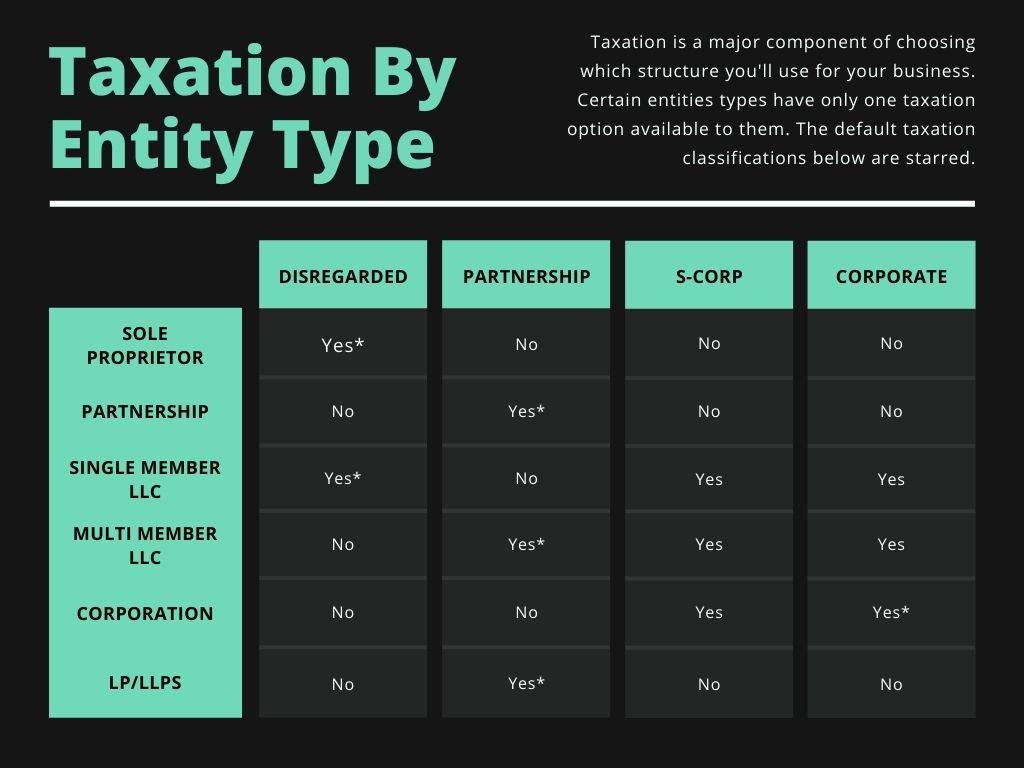

Taxation

If you have a for-profit business, your taxes fall into one of four categories.

Disregarded taxes means there’s one member and no entity-level taxation. You would report all of the income and expenses on your personal tax return.

Partnership taxation is just like disregarded, except there are multiple owners and the company has to file a partnership return and issue K-1s to the owners. Those owners would report the income and expenses allocated to them on their individual returns. There is no entity-wide taxation.

In both disregarded and partnership taxation, the sources of income keep their properties. For example, if your disregarded entity received royalties, you would report them as royalty income on your tax return. This is beneficial because royalty income has a lower tax rate and you might not owe FICA taxes on it.

Corporations are separate legal entities. Therefore, they have their own tax return. The corporation has to report all sources of income and expenses on its tax return. Any income the owners receive would be employment income or dividends. Since wages are deductible for the entity, small business corporations rarely have to pay any taxes themselves. Usually you end up paying yourself everything the company makes.

S-Corp taxation is a unique hybrid of partnership and corporation taxation. Basically, if you’ve paid yourself a reasonable salary in the business, you can pay out the rest as ownership equity, which doesn’t have FICA taxes. In order to elect S-Corp taxation, you have to follow their rules very strictly.

Leave a Reply