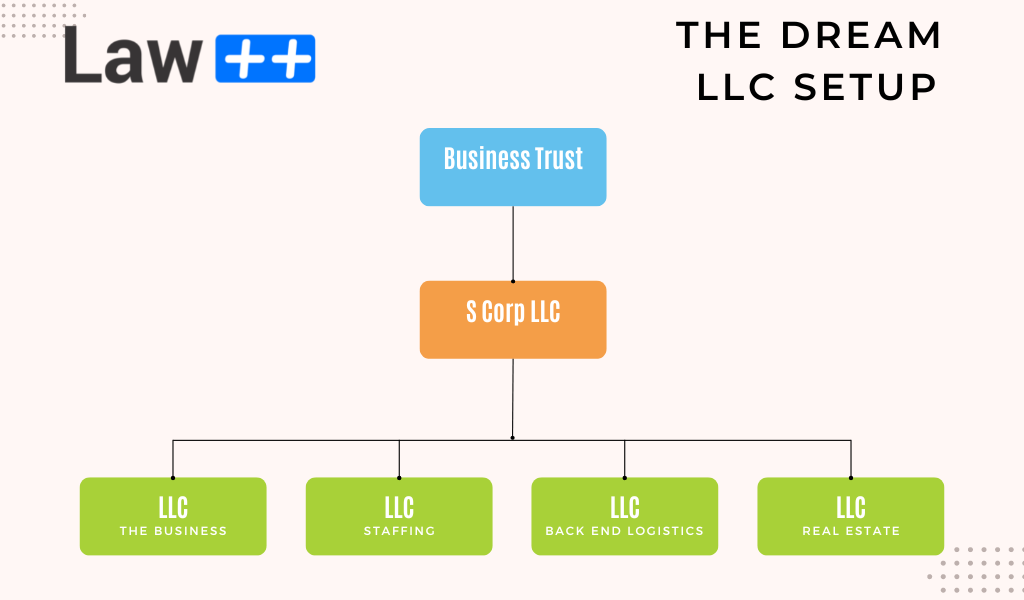

The Dream LLC Setup is generally that structure that provides the most protection and tax advantages for the owners. Ideally, one LLC protects the owners from all personal liability, but that’s not the world we live in. Certain things can’t be limited and others find their way through the veil of limited liability protection.

For the purposes of this article, we’re assuming you either have business partners or could have business partners in the future. We’re also assuming your business makes more than $100,000 per year in profit.

The major downside to our plan is cost. That’s why we start with this plan and then we subtract what makes the most sense from a cost/benefit standpoint.

It All Starts With an LLC

The Dream LLC Setup all starts with a basic ordinary run-of-the-mill North Carolina LLC. There’s nothing special about this LLC. In fact, we don’t change it’s tax election nor add any terms in its governing document. We want a regular LLC with flow through taxation that will own the assets of the company, with some limitations.

In cases of larger corporate structures, I building them top down, but it’s easier to design them bottom up. That means I figure out what needs to be on the bottom layers first and then build from there. After that, I create the topmost items first so there’s no ownership transfers necessary.

On this bottom layer, you might actually have more than one LLC because you want to separate out the liability between them. If one gets sued, the others remain unaffected. In my diagram, I have the actual business as one LLC, the employees are all retained by a second LLC, the company logistics for all of them are in a third LLC, and the company real estate is owned by a fourth. In each of these, the other LLCs subcontract with the other LLCs to get the services they need.

For example, let’s say your company is a web development company for other businesses. The actual web development contracts would be between LLC 1 and the customers. LLC 1 would then contract with LLC 2 for all its staffing needs. The second LLC would be an independent contractor of LLC 1. LLC 1 would hire LLC 3 for all its accounting, administrative, etc needs. Finally, any real estate is owned by LLC 4 and rented out to LLC 1, LLC 2, and LLC 3.

This is a good, albeit costly, way of breaking out the liability. Let’s say someone sues LLC 1 because the website crashed and lost them business. That customer is limited to LLC 1’s assets if they win against them. LLC 2, 3, & 4 are all shielded as long as they’re operated properly and all the formalities are followed.

Parent LLC Taxed as S-Corp

Next, you’ll need your Parent LLC taxed as an S-Corp. You don’t want to directly own 4 or more LLCs because that’s bad for liability, bad for logistics, and bad for taxes. Because each of your lower LLCs are flow through taxation, all of their taxes are reported on the Parent LLC’s taxes. S Corp taxation has some pretty extreme benefits if and when you make a reasonable salary. That’s why we assume you’re making over $100,000 per year to make this work. Different amounts might apply, but I’m using that as a fairly safe benchmark.

In our above scenario, let’s assume the LLCs make as follows:

| LLC | Profit |

| 1 | $50,000 |

| 2 | $25,000 |

| 3 | $15,000 |

| 4 | $60,000 |

If you have the above numbers, the S Corp would show a profit of $150,000 minus whatever minimal expenses it has itself. You then pay yourself a reasonable salary, subject to all the FICA taxes. After that reasonable salary, you can pay the rest as a dividend distribution. Dividends are not subject to FICA, which is a huge tax savings!

Beyond the tax savings, this Parent LLC provides and added layer of defense in case a plaintiff is able to pierce your LLC veil. In that case, they’d have to pierce a second LLC veil in order to go after your personal assets.

Business Trust

Next up, we have a business trust or living trust to hold the ownership of your Parent LLC. If done correctly, trusts can add a layer of asset protection for the long-term benefit of your family. Additionally, a well planned trust can potentially lower your estate taxes when you ultimately transfer the trust to your heirs or other beneficiaries. I say potentially because no one can predict what estate taxes will look like down the road.

I consider the liability protection to be the most important aspect of trusts. Having the ability to guarantee your loved ones will have something for them when you pass away is pretty valuable.

Beyond the liability, I find it very appealing how easy it is to transfer ownership of businesses held in trust. If you control the trust, you control who can benefit from the trust. No state filings. No court. All you have to do is sign a paper designating a new beneficiary to your trust. That’s it!

Ironclad Contracts

You can have all this structure in place and still be unprotect until you have the right contracts. In most cases, you can limit your liability through contracts. Not only can you limit it to a certain amount, but you can completely eliminate certain types of damages like punitive damages and force plaintiffs to sue your LLC instead of you personally. In cases where you did the physical work that caused the damages, the contract shifts that liability from you to a properly formed and managed LLC. This is your limitation of liability clause.

Unfortunately, there are some forms of liability where you cannot shift the liability in this way. For those, you have insurance and the trust.

The Operating Agreement

Got partners? Get a really good operating agreement. The operating agreement is the main contract between business partners and the company you’re partnering in. Because it’s the main one, it’s your first line of defense in case of partner disputes.

Partner disputes are the greatest threat to companies with more than one owner. One disgruntled partner can cost the company everything in a complex business suit. A very detailed and thorough operating agreement can protect from that.

Insurance

The Dream LLC Setup requires insurance. You can’t avoid all liability simply through LLCs and contracts. Furthermore, you wouldn’t want to dissolve an LLC just because someone has a claim against you. For example, you’re not going to dissolve your real estate LLC if there’s a slip and fall in your lobby. Sure, you’d be protected personally, but you’d lose that piece of real estate in the process. That’s why insurance is important.

Costs

As mentioned earlier, costs are why this is often impractical. Every LLC costs hundreds to form and $203 per year to maintain through the Secretary of State. Beyond that, every business has to have its own insurance, extra tax preparation, and ongoing formalities.

That’s a lot of extra. When it’s worth it, it’s really worth it, but if you’re making under $100,000 per year, you’re looking at a larger than necessary chunk towards the upkeep where that money could instead be going to your pocket.

Leave a Reply