Description

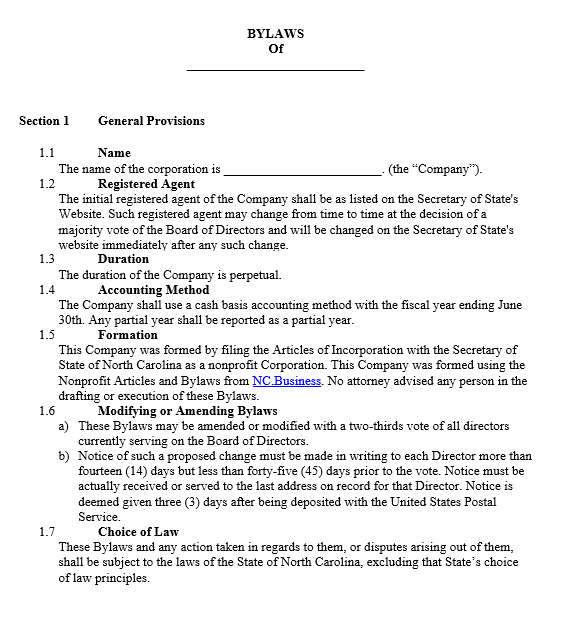

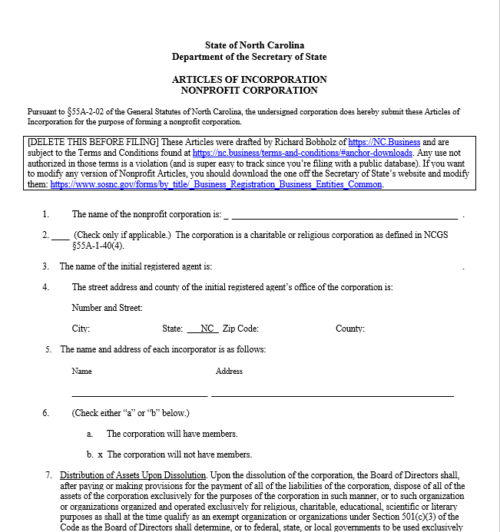

These are your Nonprofit Bylaws for a North Carolina Nonprofit Corporation. They’re a required part of every nonprofit in North Carolina, and they require certain things in order to be valid. Bylaws do not need to be filed with the Secretary of State, but they do need to be filed with the IRS if you plan on obtaining 501c3 recognition. Otherwise, they’re a private document inspectable by only certain stakeholders in your organization and the public at large. Fortunately, these cover all the legal requirements under NC and IRS law. Therefore, you don’t have to expand beyond these unless you want to.

Description

Every nonprofit corporation in North Carolina is required to have bylaws drafted, adopted, and ratified by the Board of Directors of that nonprofit. These are a legally sound starting point for your nonprofit and include such things as:

- Governance and Board of Directors;

- Executive Team;

- Duties;

- Purpose; and

- Dissolution.

Numerous organizations use these bylaws to support their purpose. Additionally, the IRS has approved these every time an entity has sought 501c3 recognition with Law++ as their lawyers. They provide a strong starting point for your organization, but feel free to adapt them to meet your company’s needs.

Features

- Editable

- Approved by IRS

- Great starter template

Related Resources

Forming a North Carolina Nonprofit Corporation

Difference Between Officers and Directors

Difference Between a Nonprofit and a Charity

Reviews

There are no reviews yet.