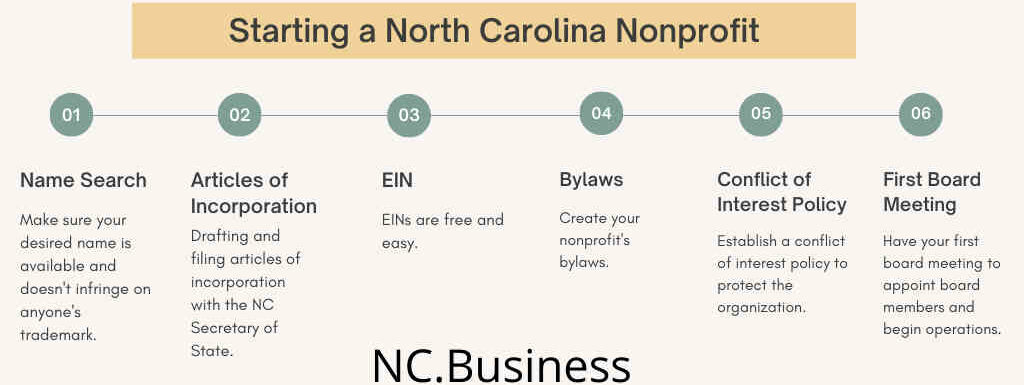

Forming a North Carolina Nonprofit Corporation is actually easier than a lot of places make you think. This guide will take you through the steps. By the end, you’ll have all the legal documents you need to set up your North Carolina Nonprofit.

In this article, we’re covering the following steps:

- Name Search

- Nonprofit Articles of Incorporation

- EIN

- Starter Nonprofit Bylaws

- Conflict of Interest Policy

- First Board Meeting

- Tips for Moving Forward

Don’t panic! This is a very long article because there’s a lot of information to go through. However, if you take it one step at a time, it’s pretty easy! Feel free to take breaks and come back. Bookmark this page and use the links above for easier navigation.

Disclaimers

Because I’m a lawyer, I need to put in a few disclaimers first.

This article is intended to be educational in nature. This is not legal advice. You’re not my client unless you and I sign an agreement that says you are. There’s no attorney-client relationship or confidentiality unless and until we’ve both signed an engagement letter.

This is based on North Carolina law that was current as of the date this article was published. If you’re in another state, these laws may not apply to you. It is also possible the laws have changed since I updated the article last.

Forming any company comes with a lot of risk. You’re taking the risk on for yourself.

We’ve provided this guide for you to go from idea to a fully formed North Carolina Nonprofit Corporation. However, if you need any help along the way, we’re here for you. Check out our affordable consultations.

What You Need to Know

Before we can dive right in, we need to cover a few things.

First, nonprofit corporations are not businesses owned in the same way for-profit businesses are owned. Technically, the state owns them and the board of directors manages them or delegates the management to officers.

Second, because of their ownership status, you can’t buy or sell nonprofits.

Third, one of the biggest concepts in nonprofit law is the conflict of interest. You always have to avoid even the appearance of a conflict.

Fourth, there’s a difference between a nonprofit and a charity. A charity is an entity that has received public charity recognition through section 501(c)(3) of the Internal Revenue Code. Obtaining this recognition requires an application and an entire process.

Name Search

The first tangible legal step towards forming your North Carolina Nonprofit is the name search. When you conduct a name search, you’re basically trying to figure out (1) if your desired name is already in use and (2) if you are infringing on anyone’s trademark rights.

Naming Guidelines

Firstly, you need to make sure you’re following the Naming Guidelines for North Carolina Companies. You’re not allowed to use certain words like “bank” or “engineer” without first getting approved by the proper legal authority.

Eliminating Potential Problems

Throughout this step, you’re eliminating potential problems. You’ll never be 100% certain that your name is available. There are just too many different ways someone could have accumulated rights in that name. For example, you’re not going to be able to check your trademark in every language on the USPTO trademark search. Instead, you’re just aiming to search the likely ones.

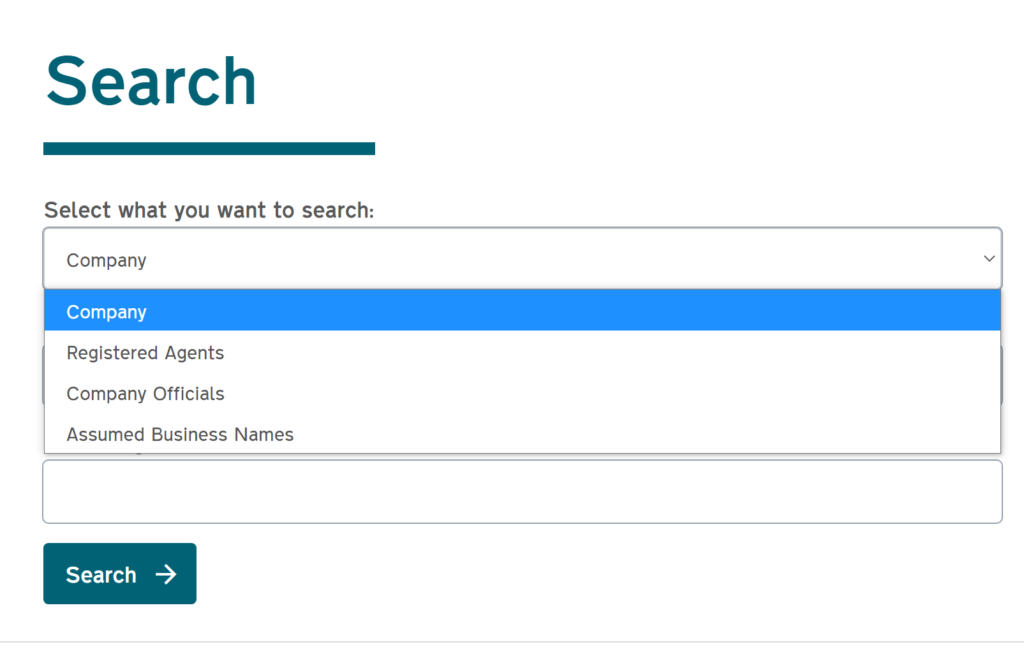

Secretary of State Name Availability

Our starting point is the North Carolina Department of the Secretary of State’s website. That’s sosnc.gov. It’s such a long name, most people call it the Secretary of State. To search name availability, go to https://sosnc.gov/online_services/search/by_title/_Business_Registration. Their search will ignore disregarded words like “the” and “to” but you have to as well. For example, if you want to form a company called “The Catskill Consulting Company,” it will read “Catskill Consulting” to the Secretary of State based on the legal naming guidelines.

When you’re checking the Secretary of State’s website, you just need to make sure there’s no other company that someone would confuse yours for. Generally, that’s just a 1:1 match you’re trying to avoid. However, I’d also recommend checking for any companies that share the same base portion of your name. Using the above example, “Catskill Consulting” as the base part, if there’s a company called “Catskill Advising,” that’s probably too close for comfort and you’ll want to pick a new name.

Alternatively, you can always reach out to the company you’re in potential conflict with and see if they’ll let you coexist or buy the name from them. Just because someone is using the name you want does not mean all hope is lost.

Numbers in Names

I’ve seen a lot of people create problems when they use numbers in their company name. Company names are not like email addresses. If someone already has “Catskill Consulting,” you cannot name your company “Catskill Consulting 2.” It would pass the Secretary of State’s checks, but it would be an unlawful name unless you’re the one who owns “Catskill Consulting.”

Searching the Secretary of State’s website should only take you about 5-15 minutes depending on how similar your company name is to others.

Assumed Name Availability

Next, it is time to search assumed names. Assumed Names, as they’re legally called in North Carolina, are often referred to as DBAs, fictitious names, or “also known as” names. Whatever you call them, they’re when you call your company anything besides its legal name. For example, “Law Plus Plus” is an assumed name for “R. W. Bobholz Law, PLLC”.

To search assumed names, we actually go to the same place as the Secretary of State name search. Fortunately, you just need to run through the same process as before and you’re good to go.

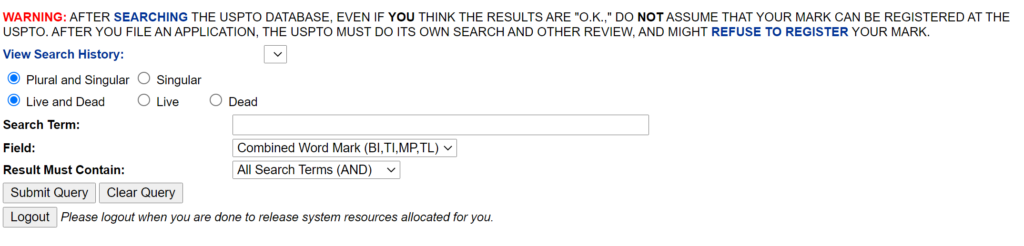

Trademark Search

Now we’re on the hardest part of the name search. In this step, you’re searching the Federal trademarks to see if there are any filed marks someone could confuse for your own. There are actually a lot of considerations during this part, so let’s dive in.

In order to violate someone else’s trademark, your name must be (1) similar enough to cause confusion and (2) in the same industry. If you don’t satisfy both of those criteria, there’s no conflict. The standard is “likelihood of confusion” for whether or not a name infringes on someone’s trademark. It doesn’t have to be an exact match.

Also, merely descriptive company names cannot be trademarked, so if you have a table making company in Durham called “Durham Table Makers Inc,” you couldn’t trademark that anyway, so there’s no point in doing a trademark search on that name.

This is one area where it helps to have an extra opinion. I find a lot of business owners find reasons why the trademarks they find are not close enough. An objective set of eyes helps.

Exact Match

Firstly, head over to the trademark search tool and type in your desired name exactly as it would appear. If nothing comes up with the exact match, move on to the next step.

If you get just one result, the search tool will bring you to that trademark specifically. Check to see if your industry conflicts with any of their industries. If there’s no overlap, you’re probably good to move on.

More likely, you’re going to see a list of results. It’s time to go through every single live one and see if there’s (1) overlap in industry and (2) likelihood of confusion in the mark. For example, “landslide” returns 36 results. Of those, only 13 are live. One of the live ones is “306 TO 223. LANDSLIDE,SHELLACKIN” whatever that means. If you’re registering just “landslide” as a type of coffee, you don’t have to worry about that weird one above.

Common Replacements

Secondly, you have to search your desired company name with common replacements. For example, sometimes people use the letter 8 inside of words that rhyme with “ate,” like “L8r.” The USPTO will not do this search for you. They will search Arabic numerals and written numbers as the same thing when they’re a separate word, but not when they’re within a word. For example, you’ll need to search both “later” and “l8r” in the above example.

Core Part

In addition to searching your company name as a whole, you also need to search just the core piece. For example, if your company’s name is Achilles Motorcycles & Racetrack Repair,” you need to see if “Achilles” or “Achilles Motorcycles” would infringe on anyone’s trademark. Remember, the standard is “likelihood of confusion” so if anyone could think you’re a subsidiary of another company, that’s potential for infringement.

Different Languages

In our “landslide” example above, you’d also have to test out other languages. Fortunately, USPTO is in English, so they require other marks be translated to English so that everyone can compare to the same language. In that landslide example, “Reliz Creek” came up. “Reliz” means “Landslide” in Spanish.

If, however, your company’s name will be in a language other than English, you’ll have to check the English form of the word.

However, I would not rely on the USPTO always returning the results for foreign languages. Therefore, you should search some of the more common languages when you’re doing your search, especially for the core parts of your mark.

State Trademark Search

Because I know you haven’t had enough fun searching databases yet, it’s time to do the trademark search again, but using North Carolina’s Trademark Search. Conduct this search the same way as you did the federal search.

Just to make sure you’re fully covered, you should also search the state trademarks for any state you’re going to have a substantial presence in. Unfortunately, you don’t have to be aware of someone else’s trademark to infringe on it. And, the Secretary of State will not search any trademark office for you before registering your company.

Therefore, even if you’re super diligent, you could still get in trouble for trademark infringement without ever knowing you were doing it. The best way to protect yourself is through a great search and then registering your company’s name as a trademark with the USPTO 3-6 months after you start. A registered federal trademark will provide a lot of protection against future infringement claims against you.

Google Search

We’re on the easier steps now. For this step, all you need to do is search your desired company’s name in your favorite search engine and see what comes up. You’re looking for the following:

- Does it look like someone should have a trademark on this?

- Is there a bad meaning or bad press behind the name I’m planning on using?

- How much competition will I have using this name online?

I actually had one client refuse this step once because she thought that Google would steal her idea. I couldn’t convince her that was ridiculous, so she registered her name without this step. Nothing bad happened, but I have to assure you that no one at Google is reviewing every single search query sent in. That’s just an insane amount of work.

Domain Name Search

If you’re looking for conspiracy theories, this is the step where they somewhat come true. I’ve put this one really low on the list because you want to check nearly everything else first. If your desired name has come through clean on every other step, it is time to see if you can get the domain.

Once you find a domain, you need to buy it. For example, if you’re looking at PaintCoveredOveralls.com for your company’s website, don’t search it, add to cart, and then come back in a couple days. Some domain selling sites will actually charge you more if they notice a domain is getting a lot of attention.

In my opinion, it is better to buy a domain and not use it than to miss out on the domain you initially wanted. For my own businesses, I tend to buy several domains because I’m not sure which one I’ll end up using. When it comes time for renewal, I just let the unused ones lapse.

Social Media

Finally, make sure you can get the handles you want for all the social media platforms. You don’t even need to use them anytime soon. Just claim them and fill in the “about” section at some point. It costs you nothing to claim them, so it’s a good idea to just do it.

Name Search Conclusion

That was a lot, right? Performing a name search for your company is not a super quick and easy process. However, it is important that it is done right. That’s why I tried to include as much information and examples as I could. Once you’ve done your search and are happy with the results, it’s time to move on to the Articles of Incorporation.

Articles of Incorporation

Next up, it is time to draft and file our Nonprofit Articles of Incorporation.

Articles of Incorporation Template

By downloading these sample Nonprofit Articles of Incorporation, you agree to my Terms and Conditions for Downloads.

Once you’ve downloaded our sample, we’re going to walk through each piece individually. The North Carolina Secretary of State also has its own articles you can use to set up your Nonprofit. However, mine are customized so that your nonprofit will be ready for potential 501c3 recognition from the IRS. If you file the ones from the Secretary of State, you will have to amend them when you apply for 501c3.

Name

You’ve done a ton of work checking to make sure your name is valid and available to be filed. You just have to put that chosen name on the line in section 1 of the articles.

Charitable or Religious Corporation

Next, if you’re planning on going for 501c3 status, or are a church, check this box in section 2.

Registered Agent

Let’s talk about registered agents. Every business registered with the Secretary of State in North Carolina is required to have a registered agent. Their job is incredibly specific. All they’re legally required to do is accept lawsuits and governmental notices on behalf of a company and forward those to the nonprofit’s management.

The reason registered agents exist is so that people in North Carolina who deal with your company can always provide notice of lawsuits to a company. The state wants to ensure that a company cannot wrong consumers and then disappear. It’s part of the tradeoff with these limited liability entities like LLCs and corporations.

If a registered agent does not accept a lawsuit or important governmental notice, the sending party may serve the Secretary of State’s office directly, and that still counts as notice for lawsuits and other proceedings. Therefore, if you don’t have a reliable registered agent, you can be sued, lose, and never know you were sued in the first place.

To make matters even worse, if the Secretary of State gets served, the clerks there will attempt to contact you and also begin dissolving your company. If you don’t stop the process, you might lose your limited liability status altogether.

Now that you know all that, you need to pick a registered agent. It can really be any person or entity with a physical address in North Carolina who is responsible enough to let you know if you get sued. You can list yourself as well. Just make sure you don’t take any super long vacations.

If you ever switch registered agents, make sure you update with the Secretary of State. Nonprofits aren’t required to file annual reports, so you don’t need to reverify every year.

Members

I’ve already marked that you don’t have members. 99% of nonprofits don’t have members. Even if you have members in your organization, they may not legally be members like this part is asking. In this case, members would be people who can vote to change the organization. Professional organizations, homeowners associations, and co-ops have members like this part is asking.

Distribution of Assets Upon Dissolution

I wouldn’t recommend changing this section at all. Either keep it or delete it. It is a necessary clause if you’re looking to become a 501c3 charity in the future. Otherwise, this clause isn’t necessary. I’ve used this language many times, and it has been approved by the IRS every time.

Basically, this clause states what is legally required anyway. Any funds or assets you have remaining if you dissolve your 501c3 charity must go to other 501c3 charities or to the state. That’s because the money was given for charitable purposes and must remain as such or revert to the state.

No Benefit to Members and Directors

This is another clause that is only necessary if you’re looking to become a 501c3 charity in the future. Either keep or delete this one as well. I wouldn’t recommend making any changes because the IRS has accepted this language as is.

Regardless of if you have this clause or not, you have the same legal obligation outlined in this provision. Basically, you can’t give equity, dividend, or payment of profits to members, directors, or officers except for reasonable compensation like wages.

That said, the IRS wants to see this policy in your articles if you’re applying for 501c3 recognition. That’s why it’s included in my sample articles.

Conflicts of Interest Policy

The conflicts of interest policy isn’t absolutely necessary, but I find it is helpful to have this portion in your articles. You’ll need a more comprehensive one regardless. However, this is a good start. We’ll cover what else to put in a conflicts of interest policy further down.

Conflicts of interest arise when a director or officer is at odds with a decision they have to make. It becomes a problem when one potential decision benefits themselves. For example, if a director has the option to vote on whether or not to hire his company for a project for the nonprofit, that director has a conflict of interest.

Principal Office

North Carolina law requires that Nonprofit corporations list a principal office location in their articles of incorporation. The Principal Office can be the same as your registered agent as long as you’re actually based there. If you list a registered agent that isn’t you, but has the same address as the principal office address, this raises a red flag in the Secretary of State’s office.

You do not need a principal office phone number listed.

Officers

Although this part is optional, it is very helpful for banking purposes. Some banks can handle articles without officers listed, but some cannot. It’s an easy step to avoid hassles at the bank. You really only need 1 officer listed. I left you blanks for others, but you can feel free to delete the rows you don’t use.

The downside to listing officers is having to change them with the Secretary of State’s office. Because nonprofits don’t have to file annual reports, you have to amend your filing every time you update your officers.

Effective Date

You don’t have to list an effective date if you don’t want to. If you leave it blank, the effective date will be the day you filed. You cannot list an effective date earlier than when you filed. I’ve only ever used this with for profit companies that want to avoid an additional annual report, so they list their effective date as January 1 of the next year. There’s not much use for nonprofits unless you have a special day in mind.

Sign & Date

Finally, we need to sign and date the articles. You would think this is an easy step, but it’s one of the most common reasons articles get rejected.

Date. The date is the date you are signing. That one is easy enough.

Incorporator Business Entity. You should never need to include an Incorporator Business Entity Name. This line exists solely for companies that mass file a bunch of articles like LegalZoom. They put LegalZoom on that line. You leave it blank.

Signature. Next, sign your legal name.

Print Name. Finally, type your legal name prior to the “, Incorporator”. Do not list any other title. Again, companies that file these in bulk have another title. You do not.

Once you’ve signed and dated it, scan in a copy or save a signed copy in .pdf form to your computer where you can find it later. You’re allowed to scan in a wet/ink signature or simply sign electronically with a stylus. Neither method has caused me any troubles in the past. Just keep track of where you saved your signed copy. We’ll need it shortly.

Setting Up SOSNC.gov Account

You can always file by mailing in your articles or hand delivering them, but online is so much easier. Their office also handles online filing faster than in person, and I often get my approved articles faster than the mail would even deliver them.

To sign up for an account, go to https://www.sosnc.gov/online_services/account/register and fill in the requested information. There are actually very few required fields.

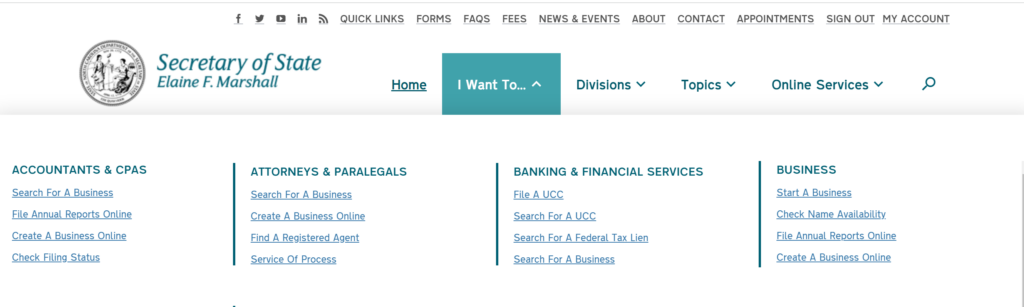

Filing Articles

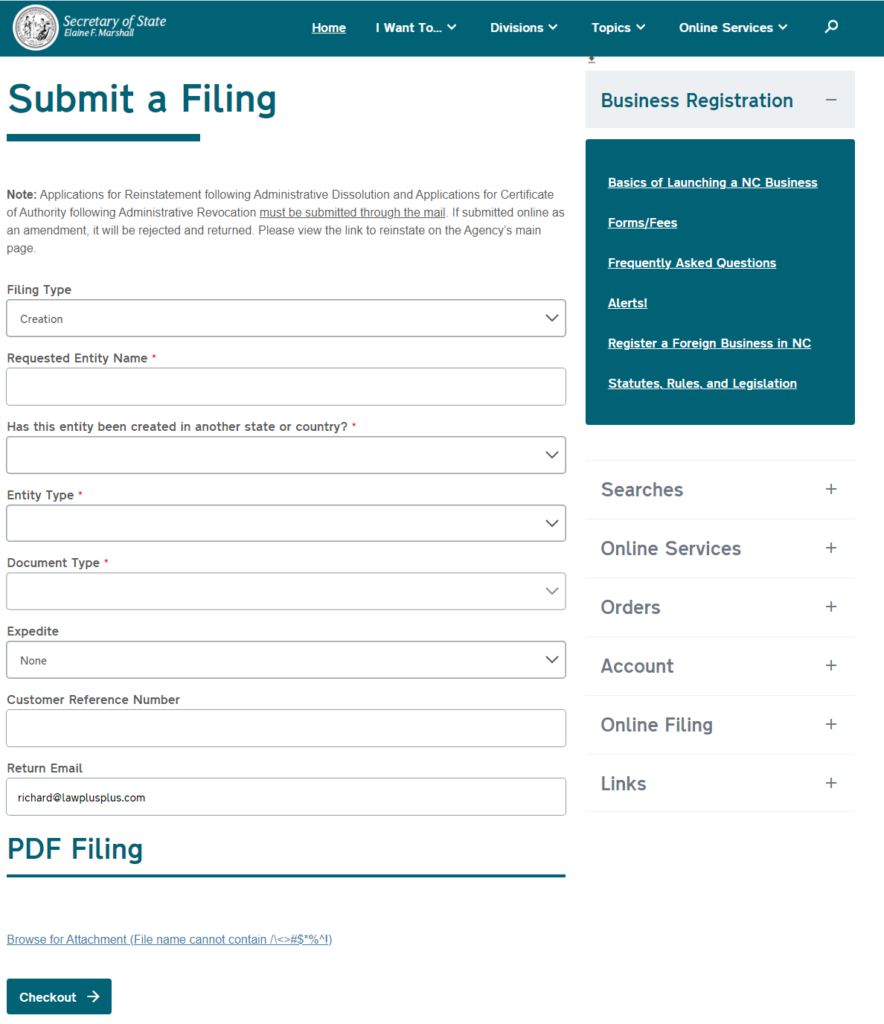

Filing your articles is also a pretty easy step. Once logged into sosnc.gov, select “Create a Business Online” from the “I Want To…” dropdown menu, as shown in the picture above or go to this link: https://www.sosnc.gov/online_services/business_registration/flow_upload_a_filing

Your page should look like the above image with the header “Submit a Filing.” If not, try the link or menu again to get to that page. On this page, complete the information as follows:

Filing Type: Creation.

Requested Entity Name: Your desired company name that you have listed on your articles.

Has this entity been created in another state or country? No.

Entity Type: Non-Profit Corporation

Document Type: Articles of Incorporation

Expedite: No, unless you want to. It costs more.

Customer Reference Number: leave blank

Return Email: Put your own email here.

Then, click “Browse for Attachment” hyperlink and upload the scanned in copy of your signed and dated articles. Once you’ve uploaded it, click Submit to go to the next screen.

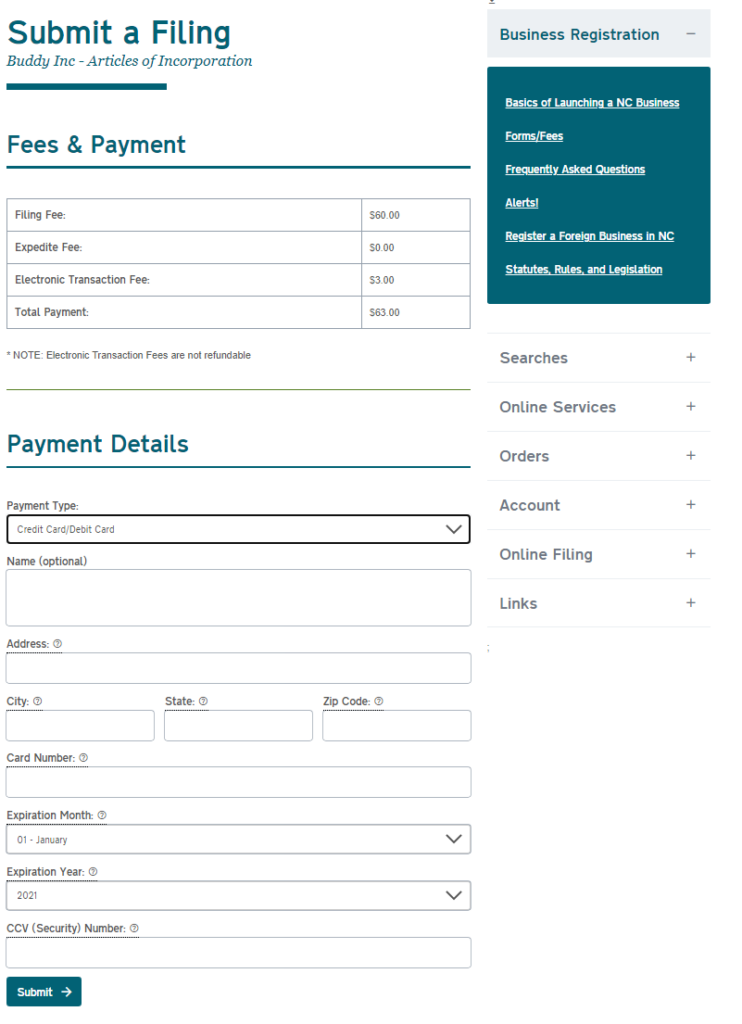

Payment Screen

This is the second of two screens where you have to fill out any information. On this screen, all you have to do is select your payment type and pay. Filing a Nonprofit corporation costs $63 unless you’ve selected to expedite your return.

Once you fill in all your payment information and click Submit, you’ll be taken to the receipt page. I recommend downloading the receipt just in case anything goes wrong.

If anything is incorrect with your articles or your name gets rejected, someone from the Secretary of State’s office will email you to have you correct it. Fortunately, you won’t have to go through the whole process again, and it won’t cost you any additional money. I’ve also found that once you’re in the emailing stage, things happen very quickly. I’ve had a clerk process my articles within 5 minutes of me emailing them back.

The Waiting Game

If you’ve submitted everything properly, all you can do now is wait to hear back. If the Secretary of State approves your articles, you will get an email with your certificate of registration and a pdf about avoiding scams. Once you get the approval email, you’re ready to move onto the next step: the EIN. You shouldn’t start that next step until you get your approval email in case your name gets rejected.

Additionally, the EIN is only legally available if you have a registered nonprofit even though the process would let you file for an EIN earlier than that.

EIN

Your EIN is your tax identification number for your nonprofit. It is like a social security number for entities. The IRS links everything tax related to your EIN. There are a lot of companies out there that charge you an awful lot for obtaining an EIN for you. It’s not that much work and they’re free. I highly recommend doing this step yourself.

At some point I guess I should mention EIN stands for Employer Identification Number, but it has nothing to do with whether you have employees or not.

How Do You Get an EIN?

Firstly, you need to go to the IRS website here. Click Apply Online Now, but keep in mind this online system is only available between 7am and 10pm EST, for some reason. You’ll get a few notices in the beginning, but then you click “Begin Application.”

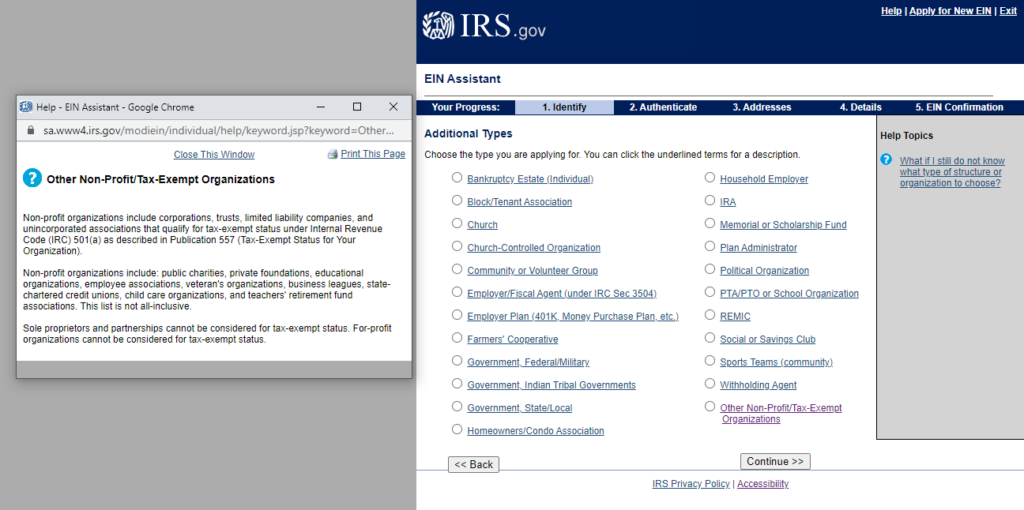

Type of Legal Structure

After you go through the warnings, you’ll be asked what type of legal structure is applying for an EIN. In your case, you’re going to click the “View Additional Types” at the bottom and click “Continue”.

Next, select “Other Non-Profit Tax-Exempt Organizations” as seen below. I included the description of that category in the below screenshot for your reference.

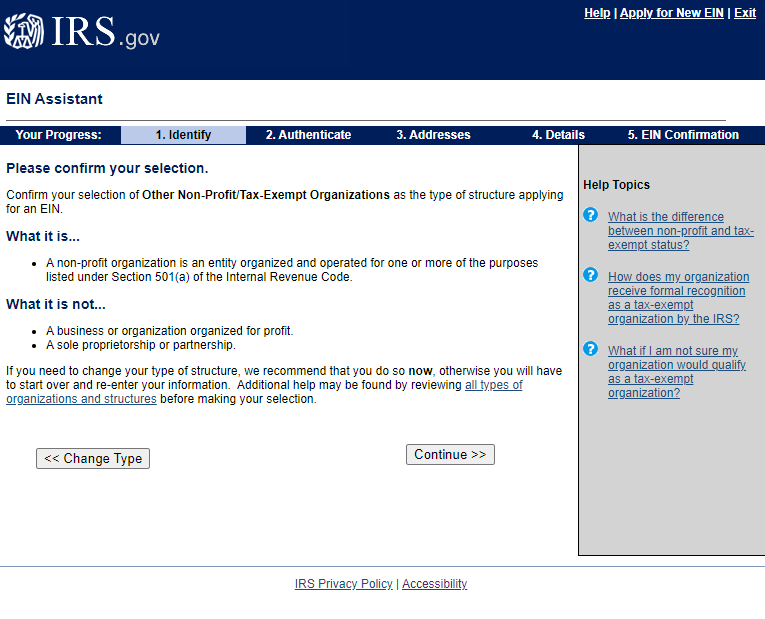

I like the IRS’s online application process because they take the time to explain each step. The next screen you get after selecting your entity type is always an explanation and confirmation page. If you’ve selected “Other Non-Profit/Tax-Exempt Organizations,” your next screen will look like the below screenshot.

As you can see above, if you’re applying for 501c3, this is the category for you.

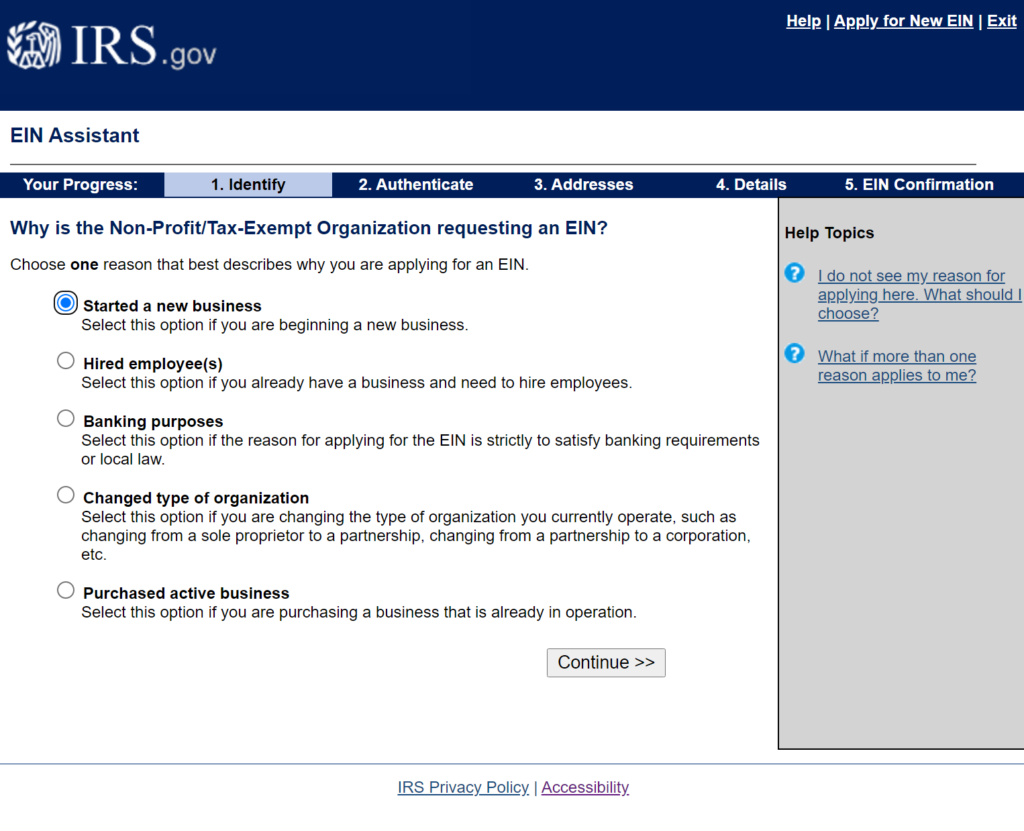

Why Are You Requesting an EIN?

Next, the application wants to know why you are requesting an EIN. 99% of the time, I’m selecting “Started a new business.” You don’t need a new one if any of the other options happen. For example, if you hire employees in a couple years, you don’t need a new EIN. Once you have one, you’re good to go. That’s the only EIN you’ll need for your business.

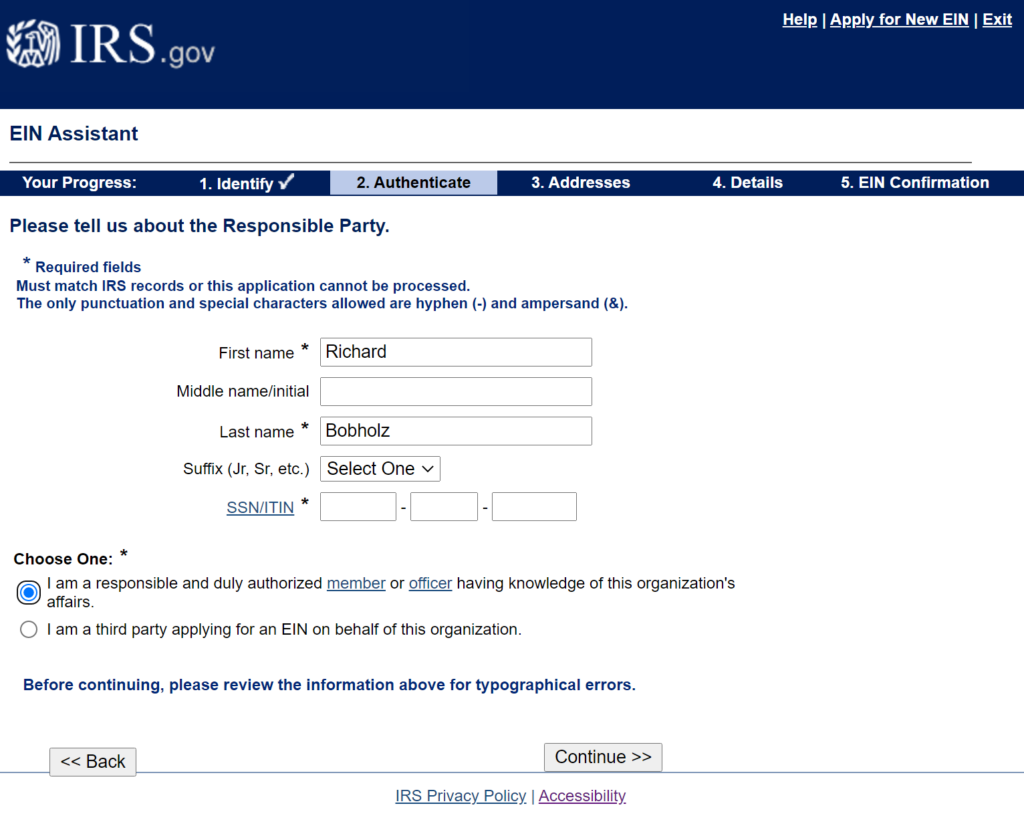

Responsible Party

The next section is the cause of most of the questions I field about EINs. The responsible party is just a person the IRS ties to the organization. They don’t owe the taxes if the company can’t pay. Instead, they’re the person the IRS contacts if there is a tax problem.

Basically, everything in the IRS must eventually tie back to a real person. Therefore, the IRS wants a real person with their social security number named as the responsible party.

In your case, you’re going to select that you’re a responsible and duly authorized member or officer having knowledge of the organization’s affairs.

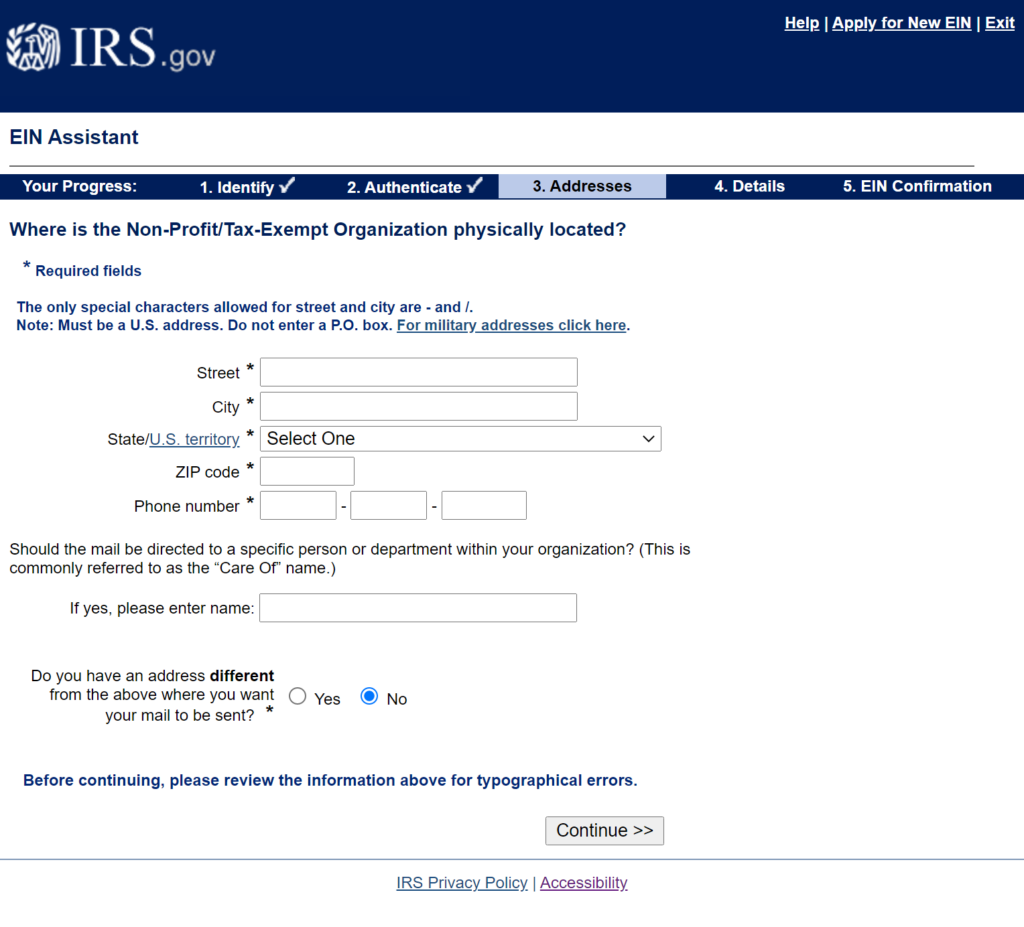

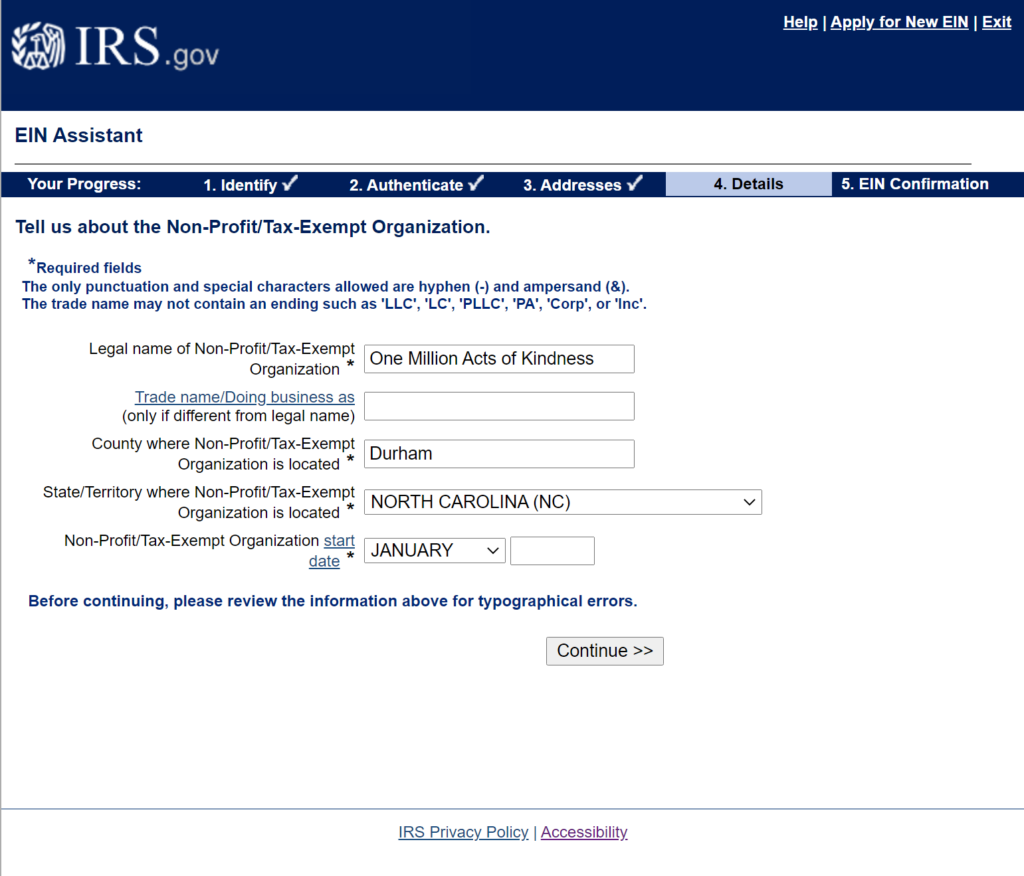

Non-Profit Information

The next couple of screens ask for general information about the non-profit. If you have your filed Articles of Incorporation from above, you’ll have all of this information right there.

You do not need to list a trade name / doing business as name on the application unless you have one filed. A trade name’s legal name in North Carolina is an assumed name.

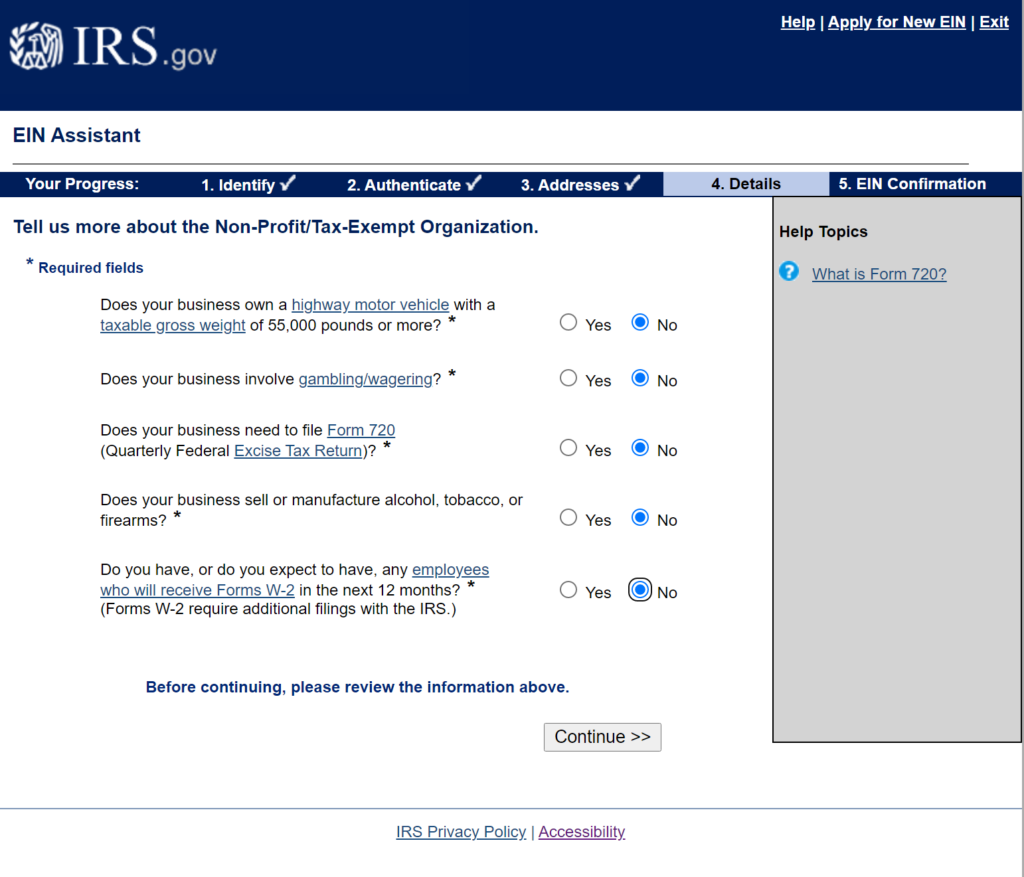

The No’s Screen

I call the next screen the “No’s Screen” because I regularly click no on all of them. However, if any of them apply to you, you should definitely check yes. For example, if you are starting with employees, you need to check yes on the bottom one.

However, if you’re not sure if you’ll have employees or not in the first 12 months, I recommend clicking no because this is one mechanism the IRS uses to catch fraud. If you click yes, but then don’t have employees, they’re going to follow up with you to see why you didn’t do any withholdings. That’s more work for you and the IRS.

Instead, once you do hire employees, you’ll just set up the withholdings accounts and register your employees with the state.

On the other hand, if you do have employees from the start, checking yes here gives the IRS a heads up. They actually mail you information on withholding taxes to help you get started. And, it’s pretty useful information!

What Do You Do?

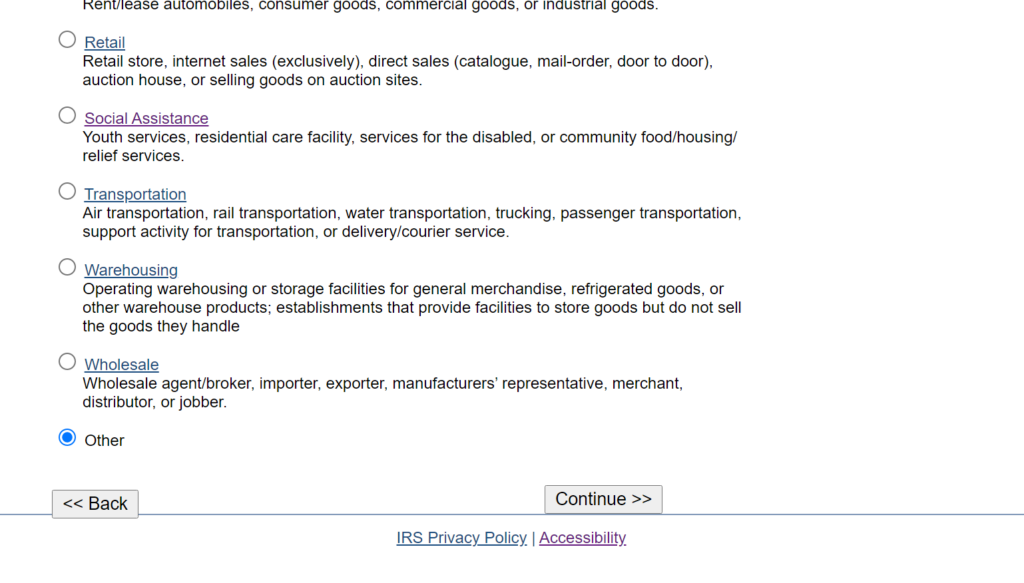

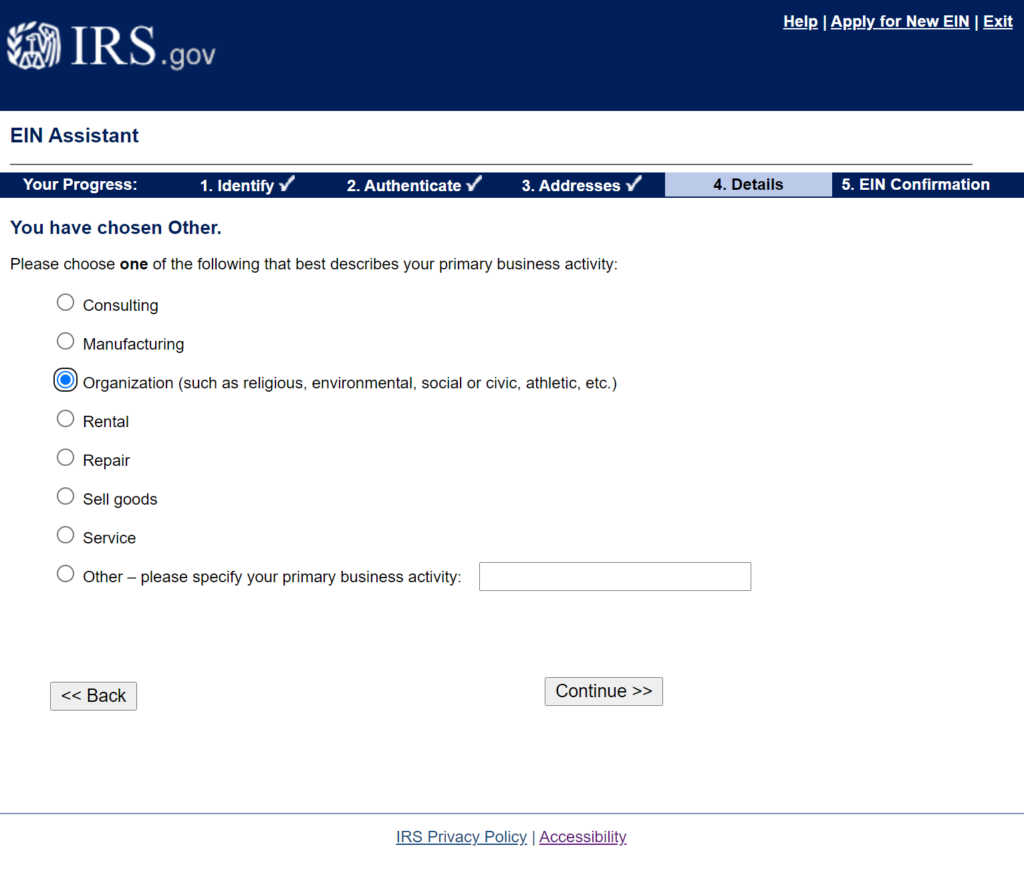

Finally, the IRS wants to know what you do as a business. I’m still not 100% sure what they do with this information, but they want it.

Most nonprofits fit into one of two categories: Social Assistance or Other. In the Other category, you’d select Organization if you’re trying to gain 501c3 status down the road.

However, nonprofits can do nearly anything a for profit business can do. For example, if you have a retail shop set up as a nonprofit, you should select Retail in this step. If you fit into multiple categories, you should select the primary activity.

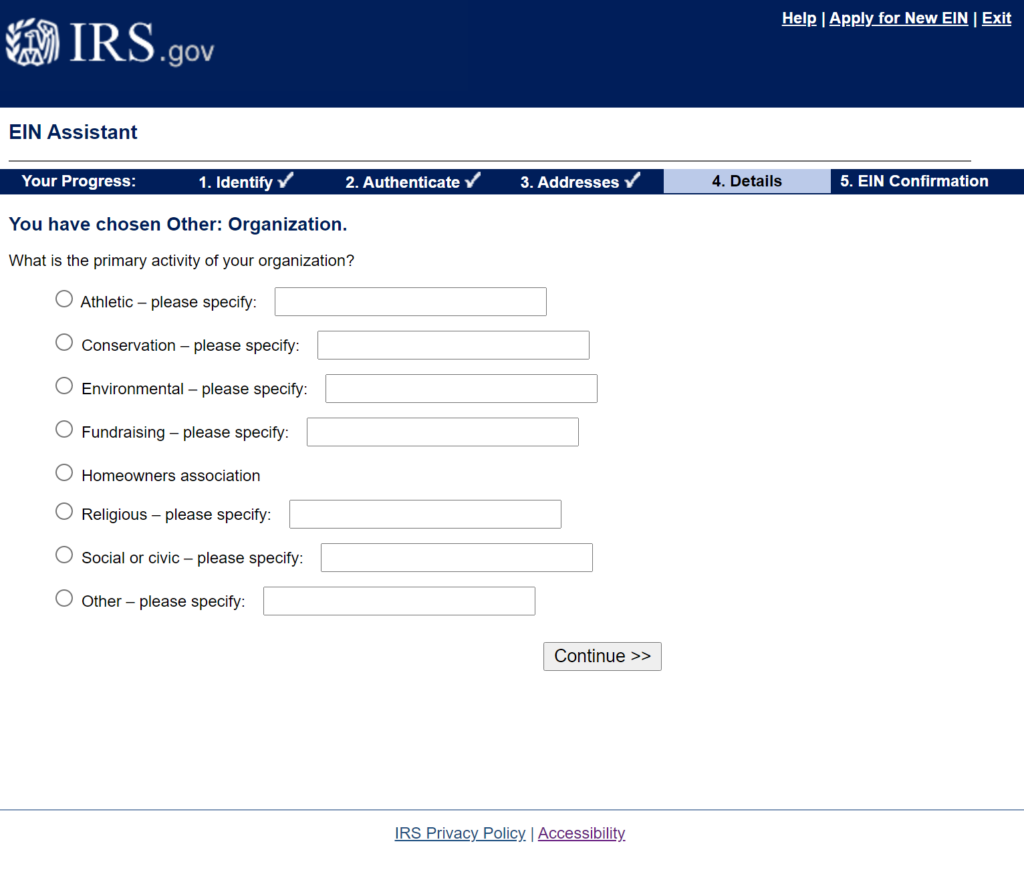

If you’ve selected Other and then Organization in the What Do You Do screens, you’ll end up with the screen you see below. Pick whichever one fits best for what your organization provides. Keep in mind that “Other” is a perfectly safe option. A lot of organizations choose Other.

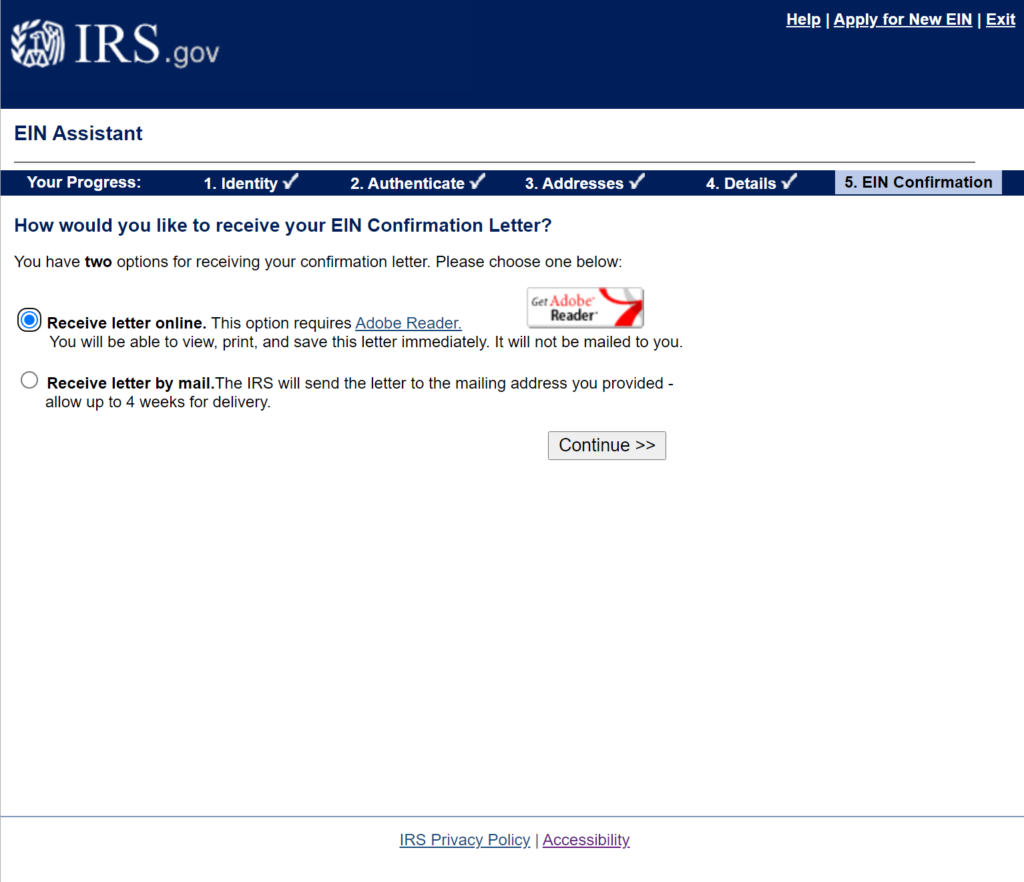

Get the PDF!

If you’re obtaining the EIN on behalf of yourself, you get the option to get an EIN instantly. Take advantage of that. However, make sure you print off a copy and save this in multiple places. The IRS is really hard to work with to get a replacement EIN letter.

Review and Submit

If you’ve gone through all the previous steps and everything has worked out, you’ll end up at the summary page. Double check that everything is entered correctly and hit Submit. It should only take a few seconds to reach the confirmation screen. You’ll be asked to click a button to download the pdf of your EIN confirmation. I would recommend also taking a screenshot of the confirmation screen for your records.

When I formed my first company, the download button had an error and I didn’t get to download the EIN pdf. I still obtained a copy in the mail in a couple weeks, so it ended up fine. However, you don’t want that stress and delay. Take that screenshot for proof.

Congratulations! You now have an EIN for your business. You’re getting very close to ready to take off running. All you have left are the bylaws, conflict of interest policy, board meeting, and solicitation license!

Nonprofit Bylaws

Nonprofit Bylaws Template

By downloading these sample Nonprofit Bylaws, you agree to my Terms and Conditions for Downloads.

The next step is the creation of your Nonprofit Bylaws. Nonprofit bylaws are very different than for-profit bylaws. Whereas for-profit bylaws have to include a lot of information about ownership, stocks, and owner disputes, nonprofits don’t have those same issues. This actually makes these bylaws relatively simple.

Regardless if you’re using our template or not, all nonprofit bylaws need cover the following topics:

- General Formation Information

- Purpose

- Board of Directors

- Meeting Information

- Executive Team

- Legal Duties & Indemnity

- Dissolution and Termination

General Formation Information

Starting off, it is important to identify the name and general information about your nonprofit. I always make the name the first section. That just makes it obvious who you’re dealing with. That might be a product of dealing with hundreds of different companies.

This section is a good place for other generic information like how to amend the bylaws, what accounting method is used, and the state laws that apply. Your nonprofit bylaws are a “private” document. However, because it’s a nonprofit, you still have to make them publicly available to certain organizations like the IRS and stakeholders that may need to see them. The content of this first section is really for those people.

Purpose

In this section, I like to list a general purpose, a specific purpose, and then any mission statements or non-discrimination policies. It’s a fairly straightforward section with minimal legalese. For your specific purpose and mission statement, write them in your own words. Make it so that someone can fully understand what you do here.

Board of Directors

Every nonprofit requires a board of directors. Nonprofits are managed, not owned. Therefore, it is up to the management of the organization to set how things happen. The highest level of management is the board of directors. Although they typically don’t handle the day-to-day operations, they legally can. There’s nothing legally preventing a board member from being a manager for the ongoing operations. However, if this happens in your organization, you’ll have to be cautious to avoid conflicts of interest.

Traditionally, the board of directors only handles big decisions. Instead of doing everything themselves, they hire or appoint an executive director to execute their overall mission. That leaves the board to make only bigger directional decisions. For example, the executive director would plan out events and coordinate volunteers. However, the board will pick which of the organization’s priorities will receive the most attention.

In this section, you need to specify how many directors there will be, how they get elected, and how they can be removed. Additionally, you should include any specific responsibilities of any board positions here.

Meeting Information

As a North Carolina Nonprofit, you’re required to have at least 1 board meeting per year. Personally, I think that is way too few. At a minimum, I think you should have quarterly meetings. The organizations that meet more regularly thrive better than those that have few meetings.

This section is all about when, where, and how you have board meetings. Any special rules about meetings should be in this section. My template is a fairly basic way of handling these.

If you want to allow electronic meetings, proxy voting, or other deviations from in-person meetings, you need to list them here. By default, nonprofits had to meet in person. However, there are actually a lot of potential changes to nonprofit laws in North Carolina coming up! One of those changes is to allow virtual meetings by default.

However, to make your nonprofit covered, you should include any meeting rules you’d like to see.

Executive Team

As mentioned above, the executive team runs the organization on a day-to-day basis. The Board of Directors appoints these positions. This section outlines what executive positions exist, what powers they have, and how they’re appointed. Executives only have powers that the board had and gave to them. Therefore, this is the section to outline all of the powers the executives have.

At a minimum, you should list an executive director. This person will be in charge of running the organization like a president or CEO of a for-profit corporation.

If your organization has special requirements for being an officer, this is the section you need to list them. For example, one of the organizations I worked with required that the officers lived or worked in Durham. This helped ensure people were connected to the community.

Additionally, you need to list how the executive team gets appointed and how they can be removed. Typically, I make it so the executives can be appointed and removed by majority vote of the board of directors. That keeps it simple.

Legal Duties & Indemnity

This section is the thickest legalese you’ll encounter in all of your nonprofit setup. I combined all the dense stuff in one section on purpose.

First off, I like to specify that directors and officers owe a duty of loyalty and a duty of care as outlined in NCGS §§ 55A-8-30 & 42.

Secondly, I include a provision limiting the liability of officers and directors as long as they act within their duties of loyalty and care. Most directors are volunteer and most officers aren’t paid enough to take on the liabilities of an organization. They shouldn’t have to worry about whether they’ll be liable in case a decision hurts the organization. It’s also good to carry insurance on directors and officers for this same reason.

Thirdly, to help protect your officers and directors, I include an indemnification provision. An indemnification provision basically states that the organization will defend and pay any lawsuit judgment against an officer or director that results from actions they took in their role as officer or director.

Finally, I add a provision that says officers and directors won’t be held personally responsible for actions the organization takes. Together, these 3 provisions create the most comprehensive protection you can create in your bylaws for your officers and directors.

Dissolution and Termination

Finally, you need to address dissolution and termination in your bylaws. In this section, you need to specify how and when the organization can dissolve. After that, you need to specify what happens to the organization and the assets in the dissolution process.

If you used my sample Articles of Incorporation, you already have a clause that outlines what happens to the assets during a dissolution. You can repeat that language here or expand upon it. Some people like to specify what charity or causes will be funded in the event of a dissolution.

In my template Bylaws, I copy the language from the articles. You can make this more specific or leave it as is.

Nonprofit Bylaws

That should do it! Your bylaws are ready to be ratified by the board of directors at your first board meeting. You can also add other provisions you’d like to include. Keep in mind that your bylaws are meant to be fairly unchanged year to year. If you want more specific governance decisions, you can always make those changes in board resolutions or through your meeting minutes.

Before your first board meeting, we need to create a conflict of interest policy. That’s next.

Conflict of Interest Policy

Conflict of Interest Policy Template

By downloading these sample Nonprofit Conflict of Interest Policy, you agree to my Terms and Conditions for Downloads.

Every nonprofit needs to adopt a conflict of interest policy. North Carolina has a Conflict of Interest law, but it doesn’t cover how you should avoid them. Therefore, you need to create one that has a procedure you can follow that also adequately protects your organization.

Our NC.Business template is tried and true. Many of my North Carolina Nonprofit clients have adopted and are using this template in their organization. Not only are they good policy, but this template has been approved by the IRS.

If you’re going to apply for 501c3 recognition, you need a Conflict of Interest Policy that the IRS will approve. This is an already approved policy for a North Carolina Nonprofit.

Interested Person

When you’re creating your conflict of interest policy for your North Carolina Nonprofit, you first have to define who an interested person is. An interested person is anyone who seeks to gain in any particular decision. It’s only ever a problem if an interested person also has control over that decision in any way.

Disclosing Conflicts

To avoid conflicts from harming your organization, you need a policy where all decision makers are required to disclose any potential conflicts. Generally, you should have them disclose directly to the board. However, as organizations grow, you might change that policy to have them disclose to their supervisor or a separate governing body.

Determination of Conflict

Next, you need a method for determining if there actually is a conflict. All directors, officers, managers, and other decision makers need to disclose potential conflicts. However, not all potential conflicts end up being real conflicts.

For example, if a volunteer offers to sell his car to a board member, that board member should disclose the potential conflict. However, it’s probably safe to say that this transaction didn’t arise from any malice towards the organization. It’s important that your team aim for being especially cautious with conflicts of interest.

Addressing the Conflict

Once potential conflicts are reported and the board determines there’s actually a conflict, you need a policy for dealing with them. If you’re a director in a North Carolina Nonprofit, you have a duty of loyalty and a duty of care to your organization. Therefore, it’s your duty to act in the organizations best interest when addressing the conflict of interest.

I prefer to use the following procedures for addressing conflicts:

- Give the interested person a short opportunity to address the conflict and how that person will uphold their duties and the conflict.

- Have a discussion without the interested person as well as a vote on what to do.

- The board should either rule the conflict isn’t an issue or make the decision for the interested person.

- Document everything.

In this policy, documentation is incredibly important. Without documentation, you still have the appearance of impropriety. In most cases, the board will make the decision on behalf of the interested person. That avoids almost all appearance of impropriety.

Penalties

Finally, you need penalties. If a person in your organization acts against the organization’s best interests or fails to disclose potential conflicts, he or she is hurting the organization as a whole. It’s important to stamp this type of behavior out immediately. Depending on the severity, a person could be written up, suspended, or even terminated for violations of this policy.

Even if the board doesn’t use these punishments in all cases, it’s important to have them when needed. In my experience, conflicts are more often encountered accidentally than maliciously.

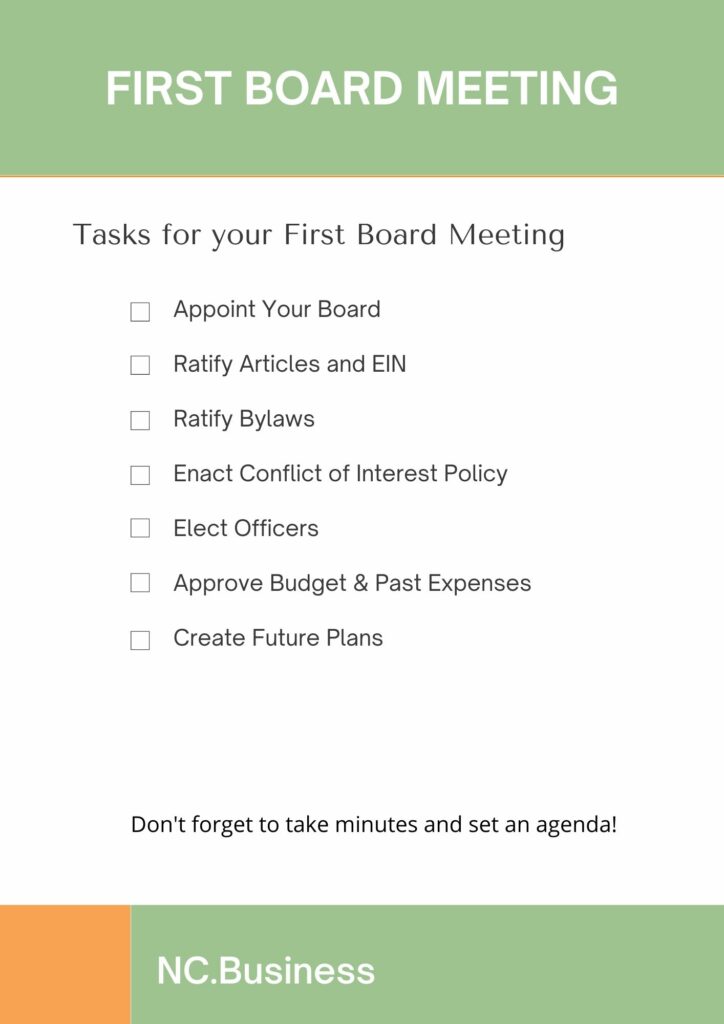

First Board Meeting

You’ve done a ton of work already. Unfortunately, up until your first board meeting, your organization isn’t even legally valid yet. The first board meeting is a legal requirement for your North Carolina Nonprofit. It’s important and necessary because several key things take place here.

I’m about to throw a lot of tasks at you in a short amount of time. Just make sure you complete everything on this checklist. You might have more based on your immediate needs, but these are the legally required ones.

Appoint Your Board

By downloading these sample North Carolina Nonprofit Appointment of Board of Directors by Incorporator, you agree to my Terms and Conditions for Downloads.

If you set up the North Carolina Nonprofit, you’re in the driver’s seat here. Your initial position is called the “Incorporator.” As incorporator, you get to appoint the first board of directors. However, if your organization has members, they get to select the board instead of you. Just another great reason to not have members.

Fortunately, as incorporator, your process is super simple. You just need to sign a document that says that you, as incorporator, appoint the following people to the board of directors for ABC Corp. It’s that easy.

Once they’ve been appointed, your board needs to select who will run the meetings. Usually, boards have a chairperson, vice chairperson, and secretary. Your board can decide these positions among themselves. Yes, you can appoint yourself, but be careful because this might create a conflict of interest if you wanted to be executive director.

Ratify Articles & EIN

By downloading these sample North Carolina Nonprofit First Board Meeting Resolutions, you agree to my Terms and Conditions for Downloads.

Next, your new board of directors needs to ratify a few things that you, the incorporator, have done on behalf of the organization. Incorporators have very limited power to act on behalf of a company. Their power basically ends when the bare minimum is completed to set up a company. In the case of a North Carolina Nonprofit, that’s the articles, EIN, and a few incidental expenses on the way. For example, it’s fine for an incorporator to obtain a domain name, but generally not okay to hire employees.

People should also not want to deal with an incorporator. Unless the board of directors ratifies the incorporator’s actions, any contracts that bind the nonprofit are null and void.

However, that doesn’t mean everyone can walk away free. Many contracts will then fall to the incorporator to fulfill them.

Let’s just get started with the big ones: ratifying the Articles of Incorporation and the EIN. These are the core elements of the organization, so this should be a no-brainer if they were done correctly.

I’ve supplied the template above that covers a lot of these ratifications in one document.

Ratify Bylaws

Next, your organization needs to ratify and adopt the bylaws. It’s pretty common to make a few changes before ratification. Because of that, you should send the bylaws to your chosen board members before the meeting. They need a chance to review all the materials you’re sending to them. This is a very intense meeting, and it would be made so much worse if everyone had to make a decision on the bylaws on the spot.

My template above also covers this.

Adopt Conflict of Interest Policy

After that, your board needs to adopt a conflict of interest policy. Whether you’re using my template or your own, you should provide it to your directors ahead of time.

Appoint Officers

By downloading these sample Appointment of Officers Template, you agree to my Terms and Conditions for Downloads.

The remaining items don’t have to happen in any particular order. I prefer to tackle officers next because it just feels right at this juncture. Your organization needs at least one officer to run the day-to-day operations. You can give this person any title you want. However, most commonly, their title is executive director or president. They can even be the officer and a member of the board of directors, though that can create conflicts.

What is important is picking someone who will fulfill their duties and help build the organization. Your bylaws should specify what officers your organization has and how to appoint them.

If you’re using my template, be sure to adjust the officers for what positions you have. If you only have an Executive Director, you do not need to appoint a treasurer. Additionally, my template above refers to the positions created in the Template Bylaws of mine, specifically Section 5.8. If you’re using different bylaws, you should refer to your officer positions in that part.

Approve Budget & Past Expenses

There are many ways to create a budget. For now, I recommend watching this video of a friend of mine on creating a budget for nonprofits. At this stage, you need to create a budget, approve that budget, and decide whether or not the organization will approve past expenses by the incorporator.

If the incorporator is on the board of directors, they cannot vote on whether to reimburse themselves for those past expenses. This is a great example of a conflict of interest. This might not seem fair, but it’s how it is. Additionally, I’ve never seen a board not approve past expenses. However, I’ve never seen unreasonable expenses by an incorporator either.

I’ve included a provision for reimbursing the incorporator in my First Board Meetings Resolutions template above.

Create a Game Plan for the Future

Now we’re finally to the fun part! Most people agree that planning for the future is a lot more interesting than ratifying bylaws. I’m a lawyer and I even think bylaws are rather boring. They’re important to have, but the nonprofit’s mission is why nonprofits exist.

Take this opportunity, while you have your board in one place, to generate plans. Use everyone’s excitement to put together tentative plans for the future.

Finally, pick your regular meetings for the rest of the year. It’s best to get everyone on the same page about how often meetings are and what is expected of them. Your first years are critical for your organization’s long term survival. Therefore, you need committed board members.

Don’t Forget

Meeting Minutes Template

By downloading these sample Meeting Minutes Template, you agree to my Terms and Conditions for Downloads.

Don’t forget to take meeting minutes through all of this! Not only are they legally required, they’re important for institutional memory. You don’t need to make your meeting minutes fancy.

Additionally, if your incorporator took any other actions before this first meeting, you need to ratify those actions as well. Feel free to add additional items to the resolutions I provided where you see fit. For example, if your incorporator opened a bank account, you need to ratify that. You will also need to change the signatories on that account now that you have a board and an officer!

Tips for Moving Forward

If you’ve gone through all these steps, you have a legally established North Carolina Nonprofit! That’s a very exciting accomplishment. I can’t wait to see how your organization will improve the community.

I’ve compiled a few tips based on what I’ve seen nonprofits run into.

- You cannot ask anyone for donations until you’ve obtained a solicitation license. It’s an easy process we’ll cover in a future article.

- Donations to your organization are not tax deductible unless and until you obtain 501c3 recognition through the IRS.

- Don’t forget to file your 990s with the IRS each year. You can lose your status or have your organization dissolved if you don’t. Even if you have $0 in revenue, you still need to file.

- Keep meeting regularly as a board and keep up the documentation. Good records are necessary for a successful nonprofit.

There you have it. If I’ve missed anything or something isn’t clear, please don’t hesitate to comment or shoot me an email.

Does NC permit migration of an existing nonprofit from another state to NC?

NC does not have a mechanism to migrate an existing nonprofit or domesticate a nonprofit in our state. There is actually a bill in the general assembly to make this possible in the future: https://www.ncleg.gov/BillLookUp/2021/H696.

Great guidance. Easy to follow step by step.

Thank you so much for the detailed step-by-step guidance. Beautifully written without complicated legal terms. We are planning to form a Mongolian Community Association in Raleigh, NC.

Thanks for your comment! I hope the process goes smoothly so you can go on to the important and fun part of running the association!

This information has been so very helpful and wonderful! The process has been explained so well and I am very appreciative. You mentioned that receiving a 501c3 designation with the IRS is a “whole process” and I learned in another article that you have to apply for a solicitation license. Do you have an article that explains this process or can direct me to a website that provides the steps? The SOSNC site doesn’t break it down in a way that my pea brain can grasp it. Thank you again!

The process of obtaining a 501c3 is a larger process than the state-level nonprofit formation. The best place to start is the IRS’s website requirements: https://www.irs.gov/charities-non-profits/charitable-organizations/exemption-requirements-501c3-organizations

Besides that, I’m working on creating more resources, but unfortunately it’s not a one-size-fits-all solution because there are so many different types of charities out there.

The solicitation license is actually a pretty easy application: https://www.sosnc.gov/divisions/charities/online_filing

Your first year is free because it is based on your previous year’s revenue. One important thing to remember is even though it is an online application, you need to print, sign, have notarized, and upload the signature page for your application to be complete.

If you have any specific questions, feel free to email me at richard@lawplusplus.com or schedule an appointment with the link at the top of the page.

Excellent! Thank you for the information. You’re doing a great service for your fellow North Carolinians and it is greatly appreciated!

Your website was most helpful when we set up our Nonprofit in NC 2 years ago. I especially appreciated the use of your templates.

One question – I am the original “registered agent”. I am turning it over to a new registered agent/Board Chair. Are they required to reside in NC or can they reside in an adjacent state?

Thanks!

Stefanie, Thanks for the question. Registered agents for North Carolina Nonprofits must be people or entities that exist within the state of North Carolina. The directors of the nonprofit can reside in any state.

Thanks so much for your clarification! Greatly appreciated.